7 Winners of the COVID-19 Ravaged Retail Industry

“When you’re living on an extremely thin margin and then the rug is pulled out from under you, you go from barely surviving to not surviving,” says Saru Jayaraman of One Fair Wage, an Oakland, Calif., organization that supports restaurant workers.

But it isn’t just restaurants that are suffering. Most brick-and-mortar retail outlets are bleeding by the roadside … mugged by the COVID-19 monster. Retail sales plunged a record 8.7% in March, the biggest decline since the government started tracking data in 1992.

Despite this, personal care product producers and food and beverage companies are holding up well as restaurant and school closures are driving an increase in grocery shopping and at-home consumption.

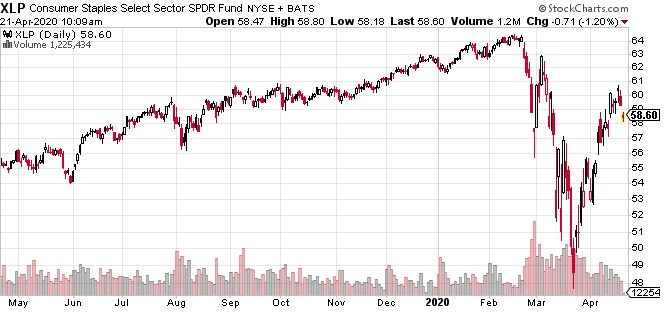

This increased spending is reflected in the Consumer Staples Select Sector SPDR ETF (XLP), which is up 5.5% over the last 12 months. Compare that to the S&P 500 Index (SPX), which is off 1.7% over the same period.

Of the consumer staples, discount stores are especially well-positioned due to their flexibility, as they can purchase inventory close to the time when it will be sold.

As the pandemic drives shoppers to stock up on food and other necessities, Walmart Inc. (NYSE: WMT) is going like gangbusters. The economic stimulus should also help Walmart shoppers, especially low-income earners.

“We’ve got a lot of categories that have seen extraordinary growth levels in the past few weeks,” Walmart U.S. Chief Executive John Furner said in a statement.

Dollar General Inc. (NYSE: DG) faces the same uncertainty as other retailers but is much better positioned to ride out the storm.

Why? Because of the company’s high consumables mix (78% of sales), strong growth outlook (12,000 additional stores on the way) and strong balance sheet. This mix makes Dollar General one of the top “all weather” investments in my opinion. Even CEO Todd Vasos said: “We currently do not anticipate a material impact on fiscal 2020 results from anything that we have experienced to date.

Another great consumer staples company is Ross Stores Inc. (Nasdaq: ROST). Like Dollar General, they have what it takes to push through a little short-term pain and hold out for long-term profits.

But don’t just take my word for it. Goldman Sachs analysts wrote: “[O]ur analysis suggests Ross Stores will continue to have sufficient cash on hand to operate into the second half, even if revenue losses during the March 15-to-June 30 time period approach 90%.”

That’s an impressive vote of confidence. Plus, the discount department store has drawn down $800 million from its credit facility, which gives it even more of a cushion.

But it’s not just groceries and clothing stores you should look out for. As COVID-19 drives workers to their home offices in self-isolation, technology retailers like Best Buy Inc. (NYSE: BBY) are also seeing a rise in demand. Their equipment is what makes those at-home workstations functional.

“We are seeing a surge in demand across the country for products that people need to work or learn from home, as well as those products that allow people to refrigerate or freeze food,” CEO Corie Barry in a statement.

And Best Buy is embracing this demand. Its e-commerce home page highlights its virtual in-home consultations for tech advice, deals on laptop computers and contactless pickup options.

Not only is it in demand now, but Best Buy also has one of the strongest balance sheets of any company I follow. This pre-coronavirus strength will help see it through the economic shutdown.

Similar to Best Buy, Office Depot’s (Nasdaq: ODP) website also features a guide to support businesses with employees sheltering in place.

Among the tips are providing enough VPN licenses for staff and making sure home offices meet IT security protocols.

Office Depot also sells workstation bundles, along with technology offerings. This will definitely help them ride out the COVID-19 storm.

The Home Depot Inc. (NYSE: HD) and Lowe’s Companies Inc. (NYSE: LOW) are two last retailers on my list that superbly fit to serve communities, especially in times of crisis.

Hot water heaters, refrigerators, electrical and plumbing repairs, bottled water and items like tarps, propane and batteries will always be in demand. And both also sell the hottest commodities in the country right now — disinfecting and sanitizing products.

Both have been declared “essential businesses,” and for good reason. So, they’re able to operate both online orders and in-store purchases, which offers a unique advantage in this market.

These are tough times, and no one is sure what the other side will look like when all is said and done. But there are still solid companies helping supply people with what they need and getting themselves through this tough time as well. They’re adjusting and doing what they can to make the most of this unfortunate situation. It’s time you do the same with your investing strategy.

All the best,

Sean