We know that solar power use is expanding rapidly. According to the U.S. Energy Information Administration, solar-generated electricity — including distributed solar — expanded by 22% year-over-year in the first six months of 2020.

At the same time, the price of solar power is collapsing. The two go hand-in-hand.

Better yet, it could be very profitable for you.

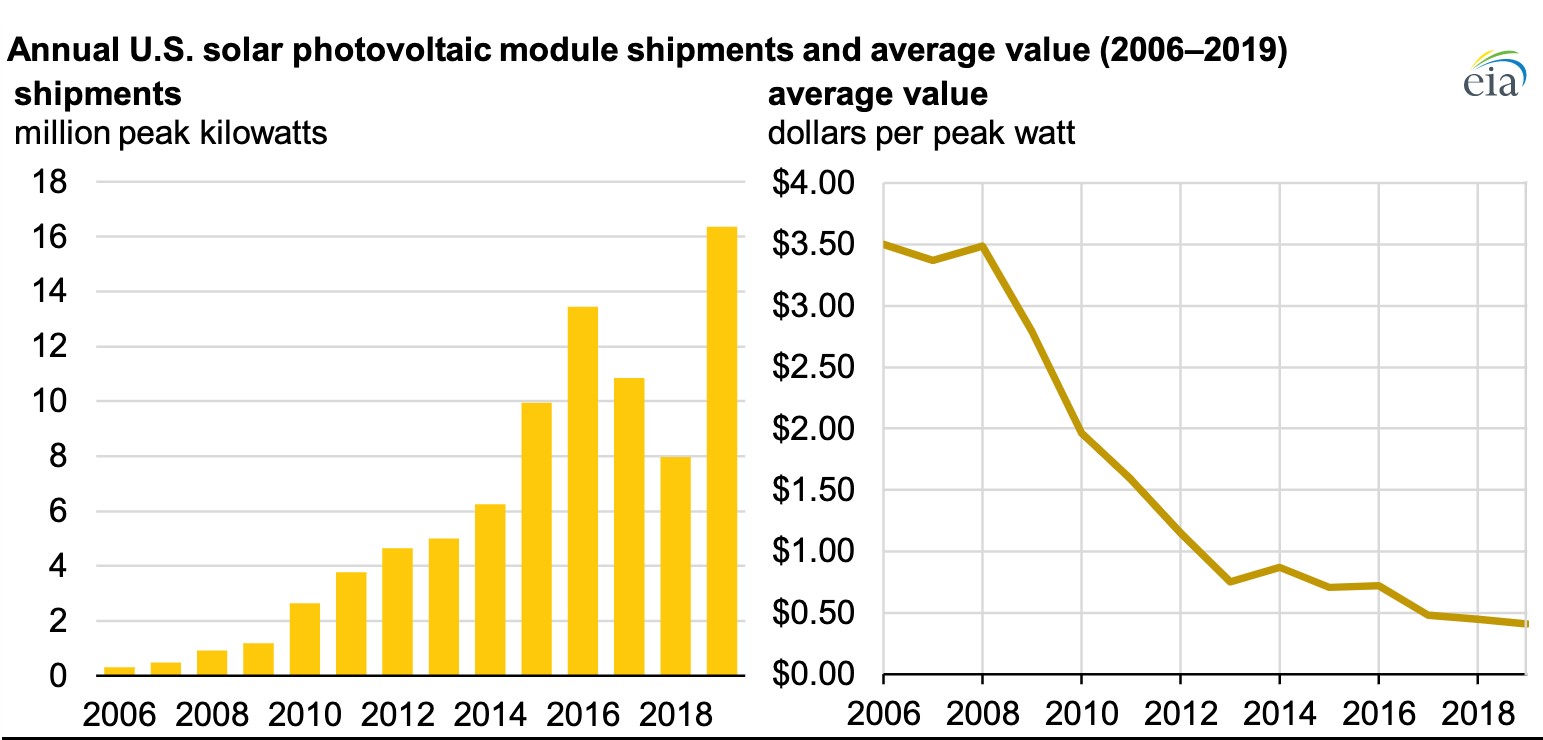

The EIA just reported that the price of solar panels alone (not including installation costs) dropped nearly nine times over since 2006. In other words, module prices decreased from $3.50 per peak watt in 2006 to 40 cents per peak watt in 2019.

And prices keep falling. The website PVInsights.com shows the average price for a polycrystalline solar PV module (your typical solar panel) has an average cost of about 17 cents per watt. That means the roughly $2 per watt price of solar in 2010 was approximately 12 times higher than it is today.

And that means tremendous savings for anyone installing solar power.

My friend Patrick Repper is one such person. He’s having a solar system installed at his new home in North Carolina. The size of the system is 15.695 kilowatts, and it comes with a 25-year warrantee. It should produce 18,592 kilowatts per year. It’s costing him $46,687.66. With a tax credit of $12,138.79, he will end up paying $34,548.87. For 25 years. That’s $1,381.95 a year, or $115 per month. Including fees, he’ll spend $183 per month on power.

Patrick explains that since his local provider, Duke Energy Corp. (NYSE: DUK, Rated C), raises its rates by 3% to 5% per year, this deal is a no-brainer.

“I’ll reduce my monthly average cost, change a variable cost into a fixed cost and reduce my carbon footprint,” Patrick told me.

And, not for nothing, $34,500 is less than I paid for my Honda.

So why is the price of solar panels falling through the floor — faster than many experts thought possible? There are a couple reasons …

Blame China!

The Chinese are driving the price drop by manufacturing efficient solar cells cheaper than many experts thought possible. Chinese multicrystalline silicon modules are the most common type on the world market. The Chinese make them at scale, they make them fast and they are making these modules less expensively all the time.

PERCs of the Job

There are different types of solar cells and new tech is coming along all the time. One that has been a game-changer for efficiency (and therefore price) is the “Passivated Emitter and Rear Contact” solar cell, or PERC.

This allows some of the sun’s rays to reflect back into the solar cell, giving them another opportunity to be turned into energy. This modification allows PERC cells to produce anywhere from 6% to 12% more energy than conventional panels, making the systems more efficient and lowering the overall cost per watt.

More Developments

Starting next year, any new commercial or residential property built in California MUST have solar panels. California is a trend-setter for the nation, so expect that trend to spread — ESPECIALLY if Democratic presidential nominee Joe Biden is elected.

That’s because Biden has committed to the “Green New Deal,” which, among other things, boosts America’s commitment to solar power.

Details are vague, but we can expect a Biden administration to renew the solar Investment Tax Credit (ITC), which started at 30% but drops to 26% this year, 22% in 2021 and zero in 2022. The ITC has sparked an average 54% increase in installations since its inception.

Another development is transparent solar cells for windows. Researchers at the University of Michigan have developed an organic — carbon-based, rather than conventional silicon — color-neutral solar cell with 8.1% efficiency and 43.3% transparency.

The U.S. Department of Energy Solar Energy Technologies Office and the Office of Naval Research back this technology, so expect to see this on building projects in the near future.

In fact, the U.S. military is investing in solar as a cost-saving measure. A 1.1-megawatt floating solar power system is being tested at Fort Bragg right now. According to energy services firm Ameresco, Inc. (NYSE: AMRC, Rated B-): “In year one of the performance period, the contract will result in utility cost savings for the Army of over $2 million, a reduction in site energy use of 7% and a site water use reduction of 20%.”

More Reasons

You don’t have to be Captain Planet to know solar is good for the Earth overall. Just this past year, Greenland shed the most ice ever recorded. Siberia is on fire, joining the West Coast of the U.S., Brazil, Australia and other hot spots around the world in widespread climate-change enhanced infernos.

U.S. scientists give a better than 99% chance that most years in the next decade will land among the planet’s top 10 hottest on record, and a 75% chance that all of them will.

There’s still time to turn things around. To do that, we need to use less coal. We need to use more solar and other “greener” power sources.

Powering Up Profits

The shift to solar and other renewables is a megatrend. The question for investors now is “how can I make money from this megatrend?”

An easy way is the Invesco Solar ETF (NYSE: TAN, Rated C). It contains a bunch of the best names in the business.

You can do even better buying individual stocks. I gave one to my Supercycle Investor subscribers back in June that’s already up more than 65%! There’s more where that came from.

The future of solar is bright indeed. Cheaper solar modules will drive demand going forward, and a Green New Deal could kick this megatrend into overdrive. This is a trend you want to ride.

All the best,

Sean