Why Biden's Stimulus May Get Bigger! And 3 Ways To Profit

On Thursday, I told you about the $2.25-trillion infrastructure package that President Biden wants to push through Congress. Does that seem big? Well, hang onto your hats … because it could get a lot bigger.

It’s Not That Much!

You know the old Washington, D.C., saying, “A billion here, a billion there; soon we’re talking about real money.” This may rattle your teeth, but what President Biden is asking for is NOT that much money in government terms.

In a speech in Pittsburgh, Biden said: “What I’m proposing is a one-time capital investment of roughly $2 trillion … that will be spread over eight years.”

That’s $250 billion a year. For reference: The Fed buys $240 billion in bonds every two months. So, no, Biden’s infrastructure proposal is NOT that big.

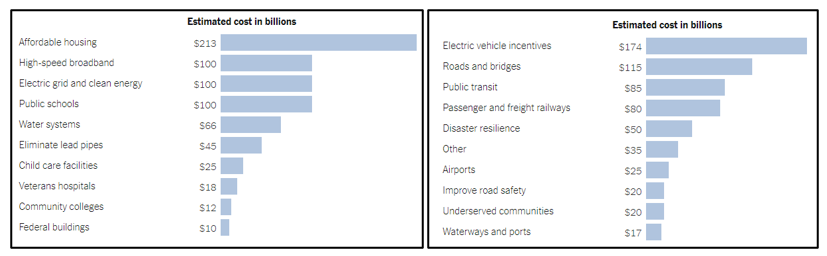

And there’s also the fact that this $2.25 trillion won’t be spent on just traditional infrastructure, as these charts from The New York Times show. Affordable housing and high-speed broadband get LOTS of money, as do electric vehicles (EVs). Then, we finally get to the electric grid and roads and bridges.

And third, when we’re talking about just infrastructure, the American Society of Engineers says it would take $2.6 trillion spent over 10 years to bring America’s infrastructure into good repair.

In fact, when he was campaigning, Biden called for the federal government to spend $7 trillion on infrastructure over a decade. So why is he now asking for “just” $2.25 trillion?

I think there is a method to his madness.

For one thing, to pay for his infrastructure proposals, President Biden is proposing new taxes on corporations, not individuals. I think he did that to keep the screams of outrage down to a manageable level.

For another, there’s this interesting chart from Amtrak showing how it will spend the $80 billion in new funding that Biden is proposing for railroads.

The light blue lines are new service, and the orange lines are expanded service. You notice what’s missing in this map? Amtrak stops at the borders of Kentucky, where Senators Mitch McConnell and Rand Paul — two of Biden’s harshest critics — hail from. And there’s no expansion in western states which are solidly Republican.

My guess is Biden — who made deals in the Senate for decades — figures he can get some Republicans on board by offering them infrastructure spending in their states.

Would that raise the cost of the infrastructure bill? Sure! But a billion here, a billion there … who’s going to complain?

And what if that’s the blueprint for the whole infrastructure package, not just Amtrak? This year is the first time in a long time that Washington D.C. is allowing earmarks in spending bills. That means your Congress-critter can ask for spending specifically to benefit your state.

Would you rather be a Congressman who brings home the bacon or one who gets nothing for the folks at home?

And that’s why I think infrastructure spending could expand a lot more as this works its way through Capitol Hill.

How To Play It

On Thursday, I gave you one idea to play the infrastructure package: the Global X U.S. Infrastructure Development ETF (BATS: PAVE). That’s still a good option.

Here are two more:

- The Defiance 5G Next Gen Connectivity ETF (NYSE: FIVG). This fund has an expense ratio of 0.30% and has decent volume. Its top holdings are NXP Semiconductors N.V. (Nasdaq: NXPI), Analog Devices, Inc. (Nasdaq: ADI), Telefonaktiebolaget LM Ericsson (Nasdaq: ERIC) and QUALCOMM Inc. (Nasdaq: QCOM).

In other words, FIVG holds a basket of companies that will benefit from a broad rollout of broadband, data infrastructure, mobile networks and more.

- Another idea is the Invesco Water Resources ETF (Nasdaq: PHO). It has an expense ratio of 0.50%. Volume is a bit light, but it’s picking up thanks to Biden’s proposal to replace all lead drinking water pipes in the country.

Top holdings include Roper Technologies, Inc. (NYSE: ROP), American Water Works Company, Inc. (NYSE: AWK), Xylem Inc. (NYSE: XYL) and Danaher Corp. (NYSE: DHR). The whole portfolio is a basket of water utilities, industrials and materials companies leveraged to water infrastructure.

Let’s look at a six-month performance chart of all three funds versus the S&P 500:

PAVE remains the outperformer, while FIVG and PHO are tied — for now. All three outperformed the S&P 500 over the past six months. Going forward, I think that outperformance should continue.

And if horse-trading starts in earnest on the floor of the Senate, and the infrastructure bill starts to balloon, then these funds could REALLY lift off in anticipation of all that spending.

Whether you think it’s a good idea or not, the money is likely going to be spent. You might as well make the most of it. And here are three good ways to do it.

All the best,

Sean