Both the Dow and S&P 500 hit news highs multiple times this week. Tech, financials and other stocks that are leveraged to easy money are driving the market higher.

But do you know which stocks aren’t doing well?

Gold miners.

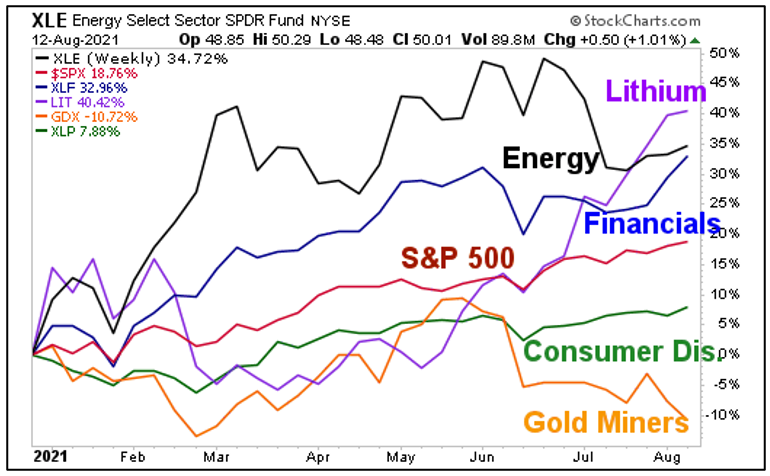

Let me show you what I mean. Below is a weekly performance chart of leading industries since the beginning of the year:

If I included more industries on that chart, it’d be unreadable. I’ve put the S&P 500 in red because you want to be above the red line.

Only three industries on this chart manage it: energy, financials and lithium.

Energy and financials are two of them, and that makes sense. They’re both reflationary trades, and right now the Federal Reserve, the Treasury Department and Congress have joined forces to make America the biggest experiment in inflation — ever …

And by that, I mean the U.S. national debt has increased by about $5.2 trillion since the start of 2020. That’s NOT including the trillion-dollar infrastructure bill that just passed, or the $3.5 trillion extra infrastructure plan Congress is working on.

$5.2 trillion is an extra $40,000 in debt per household. Inflationary? Heck, yeah!

Lithium is also above the S&P 500 — in fact, it’s leading the pack. I’ve already laid out my case for why lithium stocks should continue to lead.

The chart also shows you that consumer discretionary is underperforming the S&P 500 … for now. That could change when Congress mails out monthly checks to 32 million families — the parents of about 60 million kids. This provides $300 per child younger than six, and $250 per child age six and older. Yeah, consumers could get a boost.

But gold?

Gold is stumbling, and gold miners, as tracked by the VanEck Vectors Gold Miners ETF (NYSE: GDX), are bumping along the bottom.

We are in an economic boom. Uncle Sam’s picking up the tab. Who cares about safety … security … stability … real money. The money you CAN’T print?

Let me say that I hope this science experiment in finance continues successfully. But if it doesn’t …. well, we’ve added 5.2 trillion pigeons that could come home to roost. And the current overall national debt is north of $28 trillion. That’s a whole lot of potential roosting pigeons.

Again, I hope everything works out. But if this science experiment fails … you will want to own gold.

And you will kick yourself for not buying now, when it’s DIRT CHEAP!

After all …

1. Central banks are buying gold hand over fist. Worldwide, central bank purchases were 39% higher in the first half of this year than the first-half average over the past five years. Big buyers include Turkey, India, Brazil, Poland, Thailand, Kazakhstan and the United Arab Emirates (UAE).

Ask yourself what central banks know that you don’t.

2. Gold coins are flying out of the mint like hotcakes! The latest data from the U.S. Mint shows the amount of gold sales through July of this year is the second highest on record. And it’s not just the United States. Gold coin sales at Australia’s Perth Mint are at the highest level in 10 years! Meanwhile, China seems to be picking up the pace of gold buying, too.

It sure seems like somebody is anticipating something.

3. Miners are coiling up for a move. Gold and miners have been trading in a range for more than a year. The last time miners were at these low levels was right before a move that didn’t stop until the GDX was 27% higher!

Look at that chart I showed you. Do you want to buy something when it’s expensive? Or when it’s cheap? I prefer the latter. And gold miners are cheap!

Just something to keep in mind as America’s financial engine kicks into overdrive and roars toward the future. No one is thinking the worst can happen. I would not be surprised if the next black swan has a gold streak.

All the best,

Sean

P.S. I’ll be speaking at two upcoming MoneyShow Events that might interest you:

1. I will appear at a VIRTUAL MoneyShow, the Money, Metals and Mining Virtual Expo, from Aug. 24 to 26. I’ll be talking about the coming gold rush in battery metals: Lithium, cobalt, copper, nickel and more. Some of these stocks are already blasting off; more will follow. You can register for this virtual event for FREE. To do that, just CLICK HERE.

2. I’ll also be appearing at the MoneyShow Las Vegas. The event runs from Sept. 12 to 14. I’ll be speaking about cannabis stocks with enormous potential, and also moderating a panel of cannabis company executives. It’s going to be a great show chock full of useful information. And it’s in Vegas, baby! You can find out more about the MoneyShow Las Vegas HERE.