Apparently, all we need is a crisis for people to decide that some laws are just silly.

Just look back to prohibition. Good intentions ran rampant, leading to silly laws prohibiting personal liberties. Not to mention eviscerating a booming industry.

The Great Depression changed all that. When the market crashed and the economy got squeezed, people realized the potential profits in making booze legal again.

I’m hoping society will make that same decision about anti-cannabis laws. There are still states where cannabis possession is a serious offense. But offenders today aren’t just risking getting locked up. They’re facing the possibility of getting thrown in a jail experiencing a COVID-19 outbreak. So, getting arrested for pot could shockingly turn into a death sentence.

It would be silly if it weren’t so sad.

I live in South Florida. The Florida Senate is lobbying the courts to block proposed recreational cannabis amendments from 2022 ballots. Really? There are people dropping like flies in Florida nursing homes from COVID-19, and this is the best use of your time?

At least we have medical cannabis in Florida. And Florida, like most states with legal marijuana, deems it “essential” due to its medical uses.

And thanks to the pandemic, dispensaries saw a massive spike in demand. I spent some time calling around to local dispensaries here in South Florida and learned that they’re selling out of high demand items fast. As in, the day after delivery fast.

This makes sense. People aren’t spending money on clothes, eating out or sporting events. So, they have disposable income for cannabis. At least for now, anyway. And Florida seniors love their “herbal” cure-for-what-ails-you.

Trulieve Cannabis Corp. (OTCQX: TCNNF) is the biggest fish in the Florida medical marijuana market with 45 dispensaries. The company’s CEO, Kim Rivers, recently talked about how her company is adapting to the pandemic in an interview with the website, Grizzle.

“Recently the number of deliveries has increased dramatically … about 500%,” Rivers said. “We now have approximately 200 vehicles that are on the road day in, day out.”

But curbside pickups have become an even bigger part of Trulieve’s business. Rivers says curbside pickups now represent 65% of Trulieve’s transactions. The company’s business “has flipped completely,” she said. “We are primarily a pickup/delivery retailer now, with walk-in representing 20% to 25% of our business at this point in time.”

But pandemic + pot = profits is too simple an equation.

Sure, when America realized it would have to hunker down for the pandemic, there was a huge rush at dispensaries as people stocked up on pot, driving sales through the roof. Now, sales are showing the truth is more nuanced.

Illinois, for example, is still doing more than a million dollars a day in cannabis sales. California and Washington are still seeing sales rise. But other states, especially Colorado and Nevada, are seeing sales drop.

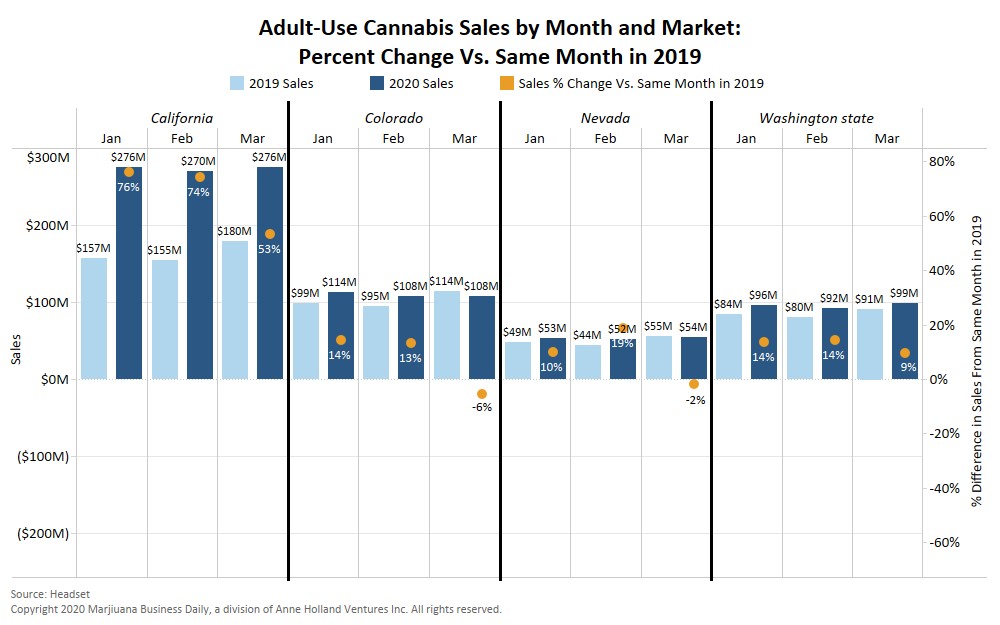

Here’s a chart from MJBiz Daily …

Recreational marijuana sales in Colorado and Nevada fell from March 2019 to March 2020. That’s the first time that monthly adult-use sales in either state dropped year-over-year. Adult-use cannabis sales in California and Washington state still rose in March 2020 compared to March 2019.

So, like I said. The outlook is mixed. Statistics from the Florida Department of Health show a 17% increase in sales of cannabis oil for the state industry in mid-March and a 37% surge for smokable marijuana. Add this growth to Florida’s designation of dispensaries as “essential businesses” and you’ve got some good reasons to buy good ol’ Florida green.

If you’re looking for more exposure to Florida, Trulieve, as I said, has 45 dispensaries. Surterra Wellness, a private company, has 39. Curaleaf Holdings Inc. (OTCQX: CURLF) has 28. Liberty Health Sciences Inc. (OTCQX: LHSIF) — which is in my own portfolio — has 23. And Cansortium Inc. (OTCQB: CNTMF) has 19.

I’ve recommended some of these to my Marijuana Millionaire Portfolio subscribers before. But if you’re doing this on your own, I’d recommend doing your due diligence. Not all these companies are “Buys” in my book.

More Pressure to End Prohibition

Taking a step back from individual companies, this pandemic could overhaul the cannabis industry as a whole. That’s because the government is desperately in need of cash right now.

The deadline for filing taxes has been pushed to July 15, so there are no funds coming in. And they’ve had to crank up the printing presses to pay for all the new social support needed to help small businesses and individuals stay afloat.

New York, which still hasn’t legalized marijuana, might see a revenue drop of $4 billion to $7 billion thanks to the pandemic. That’s according to the state comptroller. With a budget of $87.9 billion, that’s HUGE.

So, where can the government find these funds?

Just remember your history lessons! There is money to be made in a crisis … if you know where to look. And just like during prohibition, lawmakers should be looking to what’s currently taboo.

DataTrek Research’s Jessica Rabe wrote in a note, “there’s a simple and effective solution for states and cities to help cover their huge budget shortfalls after the COVID-19 pandemic subsides: Legalize recreational sales of marijuana.”

In fact, there’s talk of Cannabis Based Municipal Bonds (CMBs) to give governments and financial institutions a viable and creative way to aid in the recovery of lost revenues due to the COVID-19 pandemic.

In other words, they’d sell bonds against future cannabis tax revenue.

The coronavirus is making Americans re-assess all sorts of priorities. From shopping, to driving, to working, to health habits. I hope that cannabis prohibition is one of those things that gets on the re-think list.

All the best,

Sean