Stocks are rallying hard.

This seems counterintuitive, considering how bad the economic news is. Part of it is that investors are looking at the future.

But there is a stronger, more important force pushing the broad markets higher: central banks around the world.

They’re cranking up the electronic money printing presses to prop up pandemic-plagued markets, and that’s pumping up all kinds of assets.

This might grind your teeth if you think the market is already overvalued. But if you’re invested in the right areas, it could be very profitable indeed.

The amount of stimulus across the globe is historic by any measure. Heck, the Fed’s balance sheet surged nearly $3 trillion in just a few weeks. During the financial crisis, the Fed’s balance sheet also rose by $3 trillion. But it took FOUR YEARS to do so.

There are already whispers on Wall Street that at its June 9 and 10 meeting, the Fed will formalize its current quantitative easing program — and maybe take other measures to boost the economy, markets and stocks.

What’s more, the money supply (M2) has increased more than $2 trillion to $18 trillion since March. Following the financial crisis, it took four and a half years for the money supply to increase by $2 trillion.

We’ve seen this happen before, although on a smaller scale, in the aftermath of the financial crisis. And we saw the results: Massive asset inflation. Stocks, bonds, real estate and gold all went up. Especially tech.

Tom Essaye, editor of the Sevens Report and one of the sharpest minds in the business, writes:

The lesson of QE1 is that the liquidity flows to the secular growth stories of tech — and especially given the positive tech implications of the pandemic, and that’s hard to argue with.

To which I would add, there’s one secular growth story in the mix now that wasn’t around in the last crisis. And that’s cannabis stocks. They’re a secular growth story waiting to combust into an inferno.

Indeed, cannabis stocks are already rallying hard. Take a look at this chart.

The AdvisorShares Pure Cannabis ETF (NYSE: YOLO, Rated D) and ETFMG Alternative Harvest ETF (NYSE: MJ, Rated D) are both up strongly since the March bottom — 73% and 43%, respectively.

YOLO is up much more because it concentrates on U.S. stocks, which as a group hold more potential than Canadian stocks.

Will this continue? All the Fed money pumping says “yes.”

That’s the first reason why cannabis stocks will go up. Let me give you four more …

Cannabis Force No. 1: States Continue to Roll Out Legalization

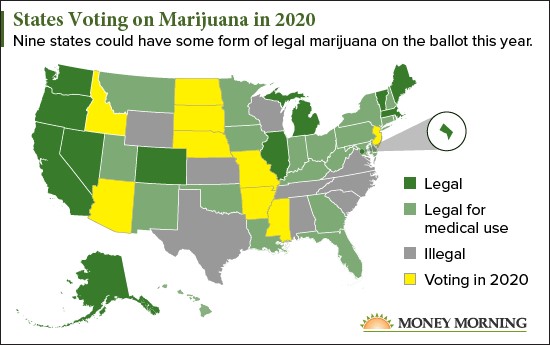

There are 33 states, along with Washington D.C., that have legalized medicinal marijuana in the U.S., with 11 having legalized cannabis for recreational use.

Those 11 states are seeing booming sales. In March, sales in leading states including Colorado, Washington, Nevada and California jumped 17% year-over-year.

This is going to become more important for these states because of a simple reason: tax revenue.

The economic havoc caused by the COVID-19 pandemic is slamming state budgets. Shortfalls across the country are projected to reach $350 billion in 2021. Cannabis taxes are a new source of revenue that could help many states bridge the gap.

Four states have pro-marijuana initiatives on the ballot this year. The legalization train keeps rollin’.

Cannabis Force No. 2: Cannabis Businesses Thrive in the Pandemic

State after state has ruled cannabis dispensaries as “essential businesses.” This is boosting sales for cannabis companies even when other businesses have had to shut their doors.

Between March 16 and March 22, recreational cannabis sales across key U.S. markets, including California, Colorado, Oregon and Alaska, were up 50% last year. At the same time, medical marijuana sales rose 41%. That’s according to data from the cannabis point of sale company Flowhub.

Cannabis Force No. 3: Anticipation of a Banking Victory

Under current laws, banks are prohibited from working with the cannabis industry. The Secure and Fair Enforcement (SAFE) Banking Act would change that.

While it was blocked by the Senate the last time Congress pushed it forward, the SAFE Act has been added to the latest COVID-19 stimulus package.

That doesn’t mean it will pass. But anticipation that it might will fuel optimism in the cannabis space.

Cannabis Force No. 4: The Times They Are a-Changin’

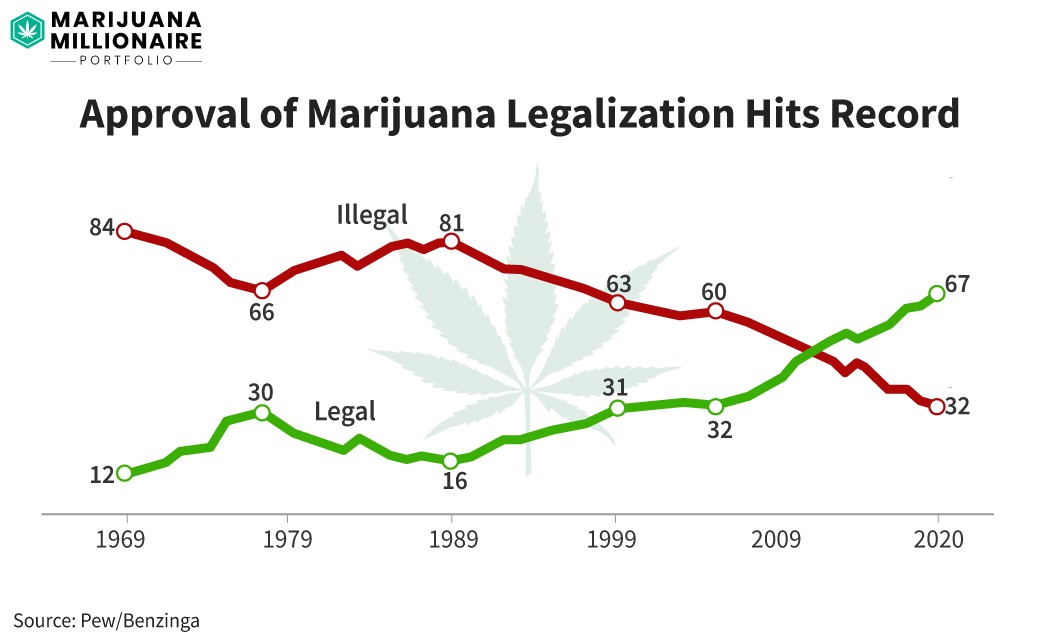

Americans have given their opinions on whether marijuana should be legal. And the pro-legalization sentiment has hit a new record.

67% of Americans now favor legalization. That’s the highest ever. And 91% now say that cannabis should be legal for either medical or recreational use.

The people are speaking up, loud and clear. And it sure sounds like we’re reaching a turning point in history.

Heck, I haven’t even talked about Cannabidiol (CBD), which has the potential to be bigger than pot. The worldwide market for CBD is expected to grow at a compound annual growth rate (CAGR) of roughly 32% over the next five years, according to a new study. That means CBD sales could reach $1.25 billion in 2024, from $311.8 million in 2019. That’s compared to a 16% CAGR for the cannabis market.

My Marijuana Millionaire Portfolio subscribers are already riding this big green wave of profit potential in cannabis. There’s a lot more to come.

If you’d like to learn more, consider watching a FREE webinar I am presenting at a virtual MoneyShow next Wednesday. Just follow this link to sign up.

I’ll explain MORE forces driving marijuana higher. I’ll give you some smokin’-hot cannabis picks. And I’ll tell you about some stocks you should avoid.

As I said, this webinar is free. And if you’re not invested in marijuana yet, it’s a great first step.

All the best,

Sean