China, Chocolate, Cannabis and Bongs & Thongs — Merry Christmas to All!

Christmas is just 10 days away, but there’s no Santa rally in sight. A lot of problems are weighing on the market, like the chains that Marley’s Ghost dragged around with him in “A Christmas Carol.”

I don’t have any ghosts of Christmas Past, Present and Future to offer you. But I do hope you are merry, kind and generous this holiday season, and that you find the same qualities in everyone you meet. And here are some interesting stories and charts you might want to keep in mind as 2018 winds down.

1. On-Again, Off-Again Trade War is Off Again

China says it will temporarily halt its additional 25% tariff on cars made in America. The Chinese are making a real attempt to cool the trade tiff and head off a trade war, observers say.

To me, the fact that the market is not heading higher on this news speaks volumes — none of it good. Either the market thinks the trade war is inevitable, or it thinks we have bigger problems. Like this one …

2. Government Shutdown Looms on Dec. 21

Unless the Congress and Senate pass a continuing resolution (CR), the government will run out of money for some operations on Friday, Dec. 21, and those operations will shut down. Departments affected include Homeland Security, State, Justice, Commerce and more.

This fracas is nominally over funding for a border wall, but it’s much deeper than that. Otherwise, the Republican House and Senate would already have passed the CR and President Trump would have signed it.

I gave my Supercycle Investor subscribers a more in-depth take on this. The bottom line is the fight over the CR will add to volatility going forward.

Fidelity explains how a government shutdown may affect investors. It’s not as bad as many think. But fear of the shutdown definitely rocks the market.

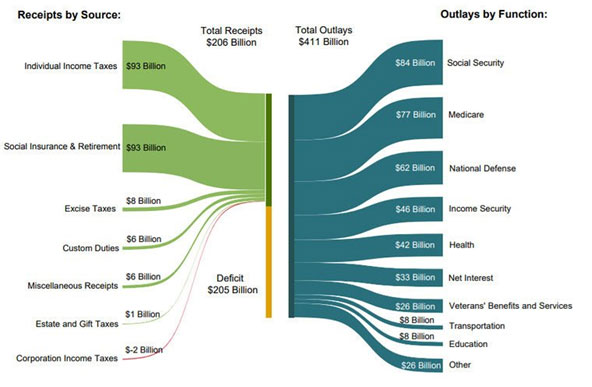

3. Budget Blowout

The U.S. budget deficit for just November 2018 was $205 billion. It was $139 billion a year ago. As the Wall Street Journal explains:

A strong economy typically leads to narrower deficits, as rising household income and corporate profits help boost tax collections, while spending on safety-net programs tends to decline. But that isn’t happening now, primarily because of the tax cuts.

The budget picture will continue to worsen as the U.S. taxes individuals and companies less and Uncle Sam spends more, mostly on defense and benefit payments to an aging population.

Have fun discussing that with your relatives at Christmas!

Here’s something that the kids may find more interesting …

4. Streets Paved with Chocolate

I’ve been in parts of Mexico where the roads are paved with gold. Literally. By that, I mean crushed waste rock from gold mines is mixed into the tar that paves the roads. But I’ve never traveled on a road paved with chocolate. I shoulda booked a flight to Germany!

That’s a metric ton of chocolate (or more) coating a road in front of a chocolate factory in Westönnen, Germany. A storage tank at the factory burst, and the chocolate made a break for it. It flowed out, then froze solid on the road.

Hoppla! (That’s “oops” in German.)

If this happened in America, I’m pretty sure local kids would have turned up to grab chocolate by the yard. However, since it’s Germany, two dozen firefighters used shovels and torches to remove the sweet stuff.

5. Cannabis Christmas Gift Comes Early

Canada legalized recreational marijuana earlier this year. But that legalization did not extend to edibles, which are very popular. In fact, I even wrote an article about them, which you can read HERE.

Edibles are a huge part of the market. Colorado’s sales of edibles and concentrates rose from 26.3% of the market in 2014 to almost 40% in 2017.

The buzz was that Canada would have to wait until later in 2019 to get legal edibles. But now, draft regulations are expected to be released before Christmas.

In other leafy news, Congress passed a farm bill that allows nationwide hemp cultivation for any use — including Cannabidiol (CBD) oil. The legislation was championed by Senate Majority Leader Mitch McConnell (R-Ky.). McConnell may be from a conservative state, but he’s definitely pro-farmer.

In other pot news, it is now legal to use marijuana, medically, recreationally or both, in 33 states. Party on, dudes. And since marijuana use is increasing among seniors, party on, Grandma and Grandpa!

Also, Nevada just approved 61 more cannabis stores. That nearly doubles the number of pot dispensaries in the state.

Michigan just turned back an attempt to make growing pot at home illegal. I think that’s a slap in the face for Big Weed. Good!

Finally, “It Was Wrong All Along to Take a Bong from Man in a Thong.” That was the headline on a story in Canada’s National Post. As the story explained:

“Jeffrey Shaver, a 32-year-old electrician’s apprentice, went viral last year when he suited up in a bright green thong, socks and sneakers, and nothing else, and proceeded to smoke marijuana outside the Kitchener, Ont., courthouse. He was protesting the confiscation by police of his bong, his pipe and three grams of ground marijuana, despite his legal right to the medically prescribed drug.”

Shaver is pressing ahead with a C$3-million lawsuit, trying to make Ontario safe for home pot smokers, and (presumably) green thong wearers.

I could show you a photo of Mr. Shaver in his thong, with his bong. Consider it my Christmas gift to you that I do not.

All the best,

Sean