Expecting a Real Estate Crash? Don’t Count on It.

Have you seen housing prices lately? They’re going through the roof!

• In May 2021, 50% of homes sold above their listing price.

• In Q1 2021, 45% of homebuyers said they were outbid on at least one home.

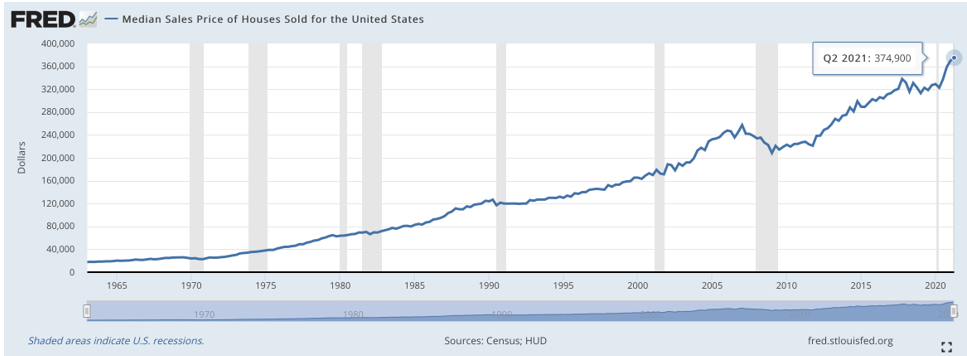

• In Q2 2020, the median home price was $322,600. A year later, that figure rose to $374,900.

This kind of action has a lot of people worried that we’re in a real estate bubble.

One that could see prices go a lot higher … and put home ownership even further out of reach for even the most qualified buyers.

And one that could send today’s sky-high prices tumbling overnight like we saw happen over a decade ago.

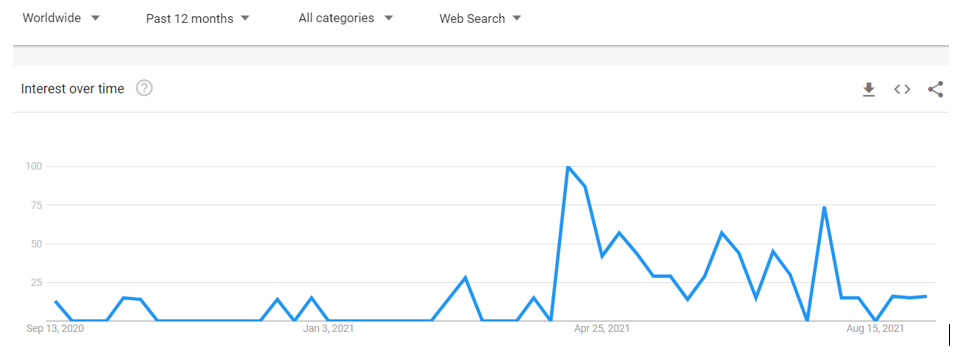

Google reported that the search term “When is the housing market going to crash?” spiked a whopping 2,450% between March and April of this year.

Many are anticipating a repeat of 2008’s real estate crash … but popular opinion doesn’t always get it right. Many assumed COVID-19 would demolish property values in 2020. Instead, home sales surged as folks rushed to buy homes in the suburbs and rural areas, particularly in the Sun Belt.

According to Jeff Tucker, chief economist at Zillow:

More affordable and medium-sized subway areas across the Sun Belt have seen significantly more people coming than going — especially from more expensive, larger cities to the north and coast.

And unlike the real estate boom that fueled the Great Recession, today’s rising market ISN’T being fueled by a failure in lender ethics.

It’s the normal battle between supply and demand:

• Investors take advantage of record low interest rates to buy homes (or apartments for income).

• Speculators (“flippers”) join the party, leading to demand exceeding supply.

• Housing prices go up.

• Eventually, fewer people can afford a home at asking price.

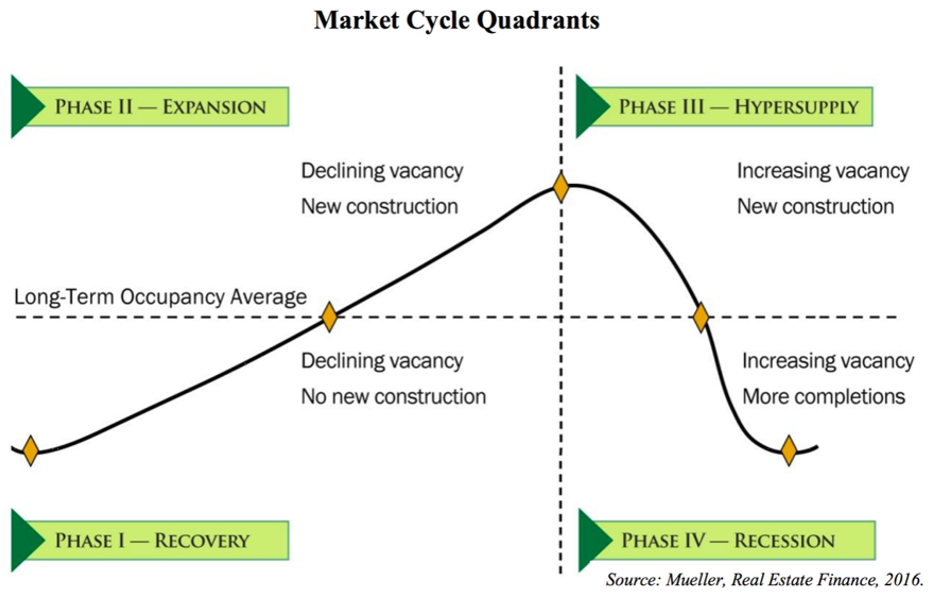

This is where we are now in the real estate cycle. Best case scenario, we can expect home prices to begin leveling off.

• But a crash? I don’t think so, at least not soon. And here’s why …

First, mortgage rates should continue to hover around record lows. The Federal Reserve says it will keep interest rates unchanged. That means borrowing costs will continue to hover near their lowest levels in history.

Second, we’re not seeing anywhere near a real estate hyper supply (Phase 3 of the real estate cycle) …

Inventories actually FELL by more than 33% over the past year. And the current supply of homes on the market remains at historic lows.

According to Freddie Mac, there is a 3.8 million shortfall of single-family homes.

On the demand side, more buyers are entering the market as the economy recovers.

Plus, newly listed properties are mostly smaller in size compared to last year. In other words, inventory is available for millennials and others looking for starter homes.

And markets are entering a golden window this fall: the return of the “off-season” and a harvest of more affordable homes for sale … all while homebuilders ramp up production to help relieve the shortage of inventory. In fact, 25% of all home listings are now new construction.

According to Urban Land Institute, home prices are expected grow an average of 4.1% over the next three years — above the long-term average of 3.9%, with single-family homes outperforming commercial, retail, hotel and rental properties.

• But there’s a wild card: the newly lifted moratorium on evictions and foreclosures.

The Center on Budget and Policy Priorities estimates 11.4 million adults living in rental housing are behind on rent.

While many have been able to find work as the economy opens up, many have not … at least not with a paycheck that’s anywhere near adequate to keep up with rising rental prices.

According to NPR:

On average, a renter in search of a modest two-bedroom home, who is seeking to stay within the 30% income window, needs to earn $24.90 per hour, the study says. (That figure is more than 3.4 times the federal minimum wage.) Those in search of a one-bedroom are in a similar position; they need to make $20.40 per hour.

Meanwhile, the government’s moratorium has effectively stopped foreclosure activity on everything but vacant and abandoned properties.

This means landlords — big and small — have suffered devastating losses of income due to (albeit reasonable) policies put in place to protect tenants from being put out on the street.

Many are underwater on their mortgages and may decide to sell their properties.

Or banks could force them into receivership to be sold … and ultimately, the flood of supply could result in price deflation.

• What about when moratoriums are lifted?

What are property values going to do when tent cities start popping up?

Evictions can be a useful tool in some cases. But multiply those by millions and we’re facing a potential disaster for the overall economy.

And just as in the case of 2008’s crash, a potential stock crash (which can never be ruled out) would lead to massive job losses … and many dropping out of the market for a home.

A multitude of homeowners would also default on their mortgages, and the increasing number of foreclosures could result in home values being driven down farther.

But that’s a worst-case scenario.

The foreclosure crisis following the 2008 housing crash was exacerbated by tens of millions of financially stressed homeowners being underwater on their mortgages.

Today, property owners are likely to have significantly more home equity. If they’re unable to repay the mortgage, they can simply sell into the hot housing market … assuming we don’t have another financial meltdown anytime soon.

Lenders are also more responsible now. And that means more homeowners with better footing.

• The U.S. housing market is unlikely to crash in 2021 or 2022. In fact, it’s playing a supportive role in the economic recovery.

Around 4.8 million millennials are turning 30 this year. That’s another positive force for both housing and the economy.

The lack of existing homes for sale means new construction is the only option for many prospective home buyers.

So, expect construction of single-family homes to keep growing in the near term.

One way to leverage this trend is with an exchange-traded fund (ETF) like the iShares U.S. Home Construction ETF (BATS: ITB).

And if you’re heavy into real estate — and worried about the worst-case scenario described above — consider adding some shares of the ProShares Short Real Estate (NYSE: REK) and/or the ProShares UltraShort Real Estate (NYSE: SRS) to hedge your real estate portfolio.

All the best,

Sean