Game On! Place Your Bets on the Emerging eSports Industry

Video gaming and electronic sports (eSports) have exploded onto the scene as rapidly emerging forms of entertainment.

eSports are competitive tournaments where teams compete against each other in various games. The most popular games include “League of Legends”, “Counter-Strike: Global Offensive” and “Dota 2”.

With COVID-19 preventing people from gathering in large groups, many have turned to gaming for both their recreational and competitive needs.

While the pandemic hurts live events in the short term, the impact of bringing in interested viewers and gamers will have an overwhelmingly positive impact for the industry moving forward.

Before COVID-19, the prize pool for the top 10 eSports games at live events reached $211 million in 2019. In 2020, the prize pool dropped to just $65.5 million. But while live viewership stalled, streaming boomed.

During the second quarter of 2020, viewers streamed 7.6 billion hours of gaming. Sure, lockdowns contributed to these record figures. But the fact is, viewers continue watching online.

According to a figure from PC Gamer in 2017, eSports gaming has a higher viewership than HBO, Netflix, Inc. (Nasdaq: NFLX), ESPN and Hulu combined. Viewership is expected to reach 646 million people by 2023.

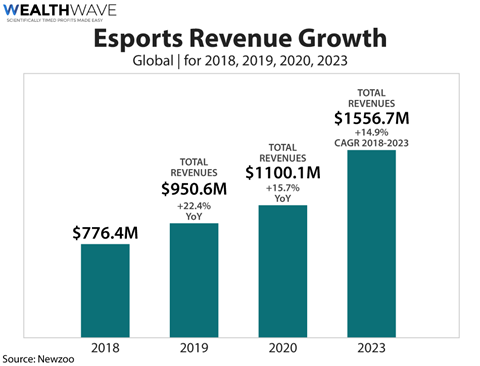

From 2018-2023, the total eSports market is predicted to grow over 14.9% annually to $1.56 billion.

The chart below shows the yearly revenue growth of the eSports industry along with growth with predictions for 2022.

Steve Bornstein, current chairman of Activision Blizzard, Inc.’s (Nasdaq: ATVI) eSports division and former CEO of ESPN and NFL Network, is extremely bullish on the emergence of eSports challenging the reach of traditional sports.

He believes that “between advertising, ticket sales, licensing, sponsorships and merchandizing, there are tremendous growth areas for this nascent industry.”

Here are two potential ways to capitalize on the emerging high-growth gaming and eSports industry …

Pick 1. VanEck Vectors Video Gaming and eSports ETF (Nasdaq: ESPO)

ESPO aims to match the performance of the MVIS Global Video Gaming and eSports Index. It’s designed to track companies focusing on video game development, eSports and the hardware and software required for their interfaces. In order to be eligible for inclusion, considered companies must collect over 50% of their revenue from gaming or eSports.

This ETF holds 25 companies predominantly listed in the U.S., China and Japan. Its top three holdings by weighting include Tencent Holdings Ltd. (700: HK), NVIDIA Corp. (Nasdaq: NVDA) and Bilibili Inc. (Nasdaq: BILI). ESPO has an expense ratio of 0.58% and manages $903 million in assets.

Pick 2. Global X Video Games & Esports ETF (Nasdaq: HERO)

This ETF tracks the Solactive Video Games and Esports ETF. It invests in video game developers, content distributers and hardware providers for virtual reality gaming. It especially looks for high-growth opportunities in the gaming space.

HERO has an expense ratio of 0.50% and manages $900 million in assets. The fund’s top holdings include Sea Ltd. (NYSE: SE), Activision Blizzard and Electronic Arts Inc. (Nasdaq: EA).

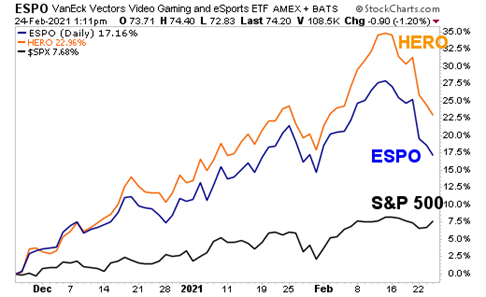

Here’s a three-month performance chart of the two funds against the S&P 500:

Which fund works best for you is really a matter of personal taste. However, HERO averages more than 300,000 shares per day, compared to 165,000 for ESPO. So, you may find tighter bids on HERO.

These ETFs provide meaningful, diversified exposure to an industry betting on the future of gaming. COVID-19 has its accelerated growth, and a younger generation of heavily engaged customers will continue spending their time and money pursuing it.

All the best,

Sean