One of the results of the Fed’s monetary manipulations is an exacerbation of the cycle of inflation and deflation … or the “Boom-Bust” cycle.

While the Fed has been trying to support inflation — supposedly to support economic growth … the COVID-19 crisis is keeping our economy under its thumb.

On the other hand, human nature being what it is — and with the War Cycles converging — conflict is again erupting, escalating and spreading worldwide.

Plus, we’re at a MAJOR 1000-year cycle top …

Which only confirms we’re on the cusp of major financial upheavals.

Which means “fear money” will pour into U.S. markets, driving the dollar up.

It’s an economic tug-o-war.

My prediction: Deflation will gain the upper hand. At least in the near term.

Inflation vs. Deflation

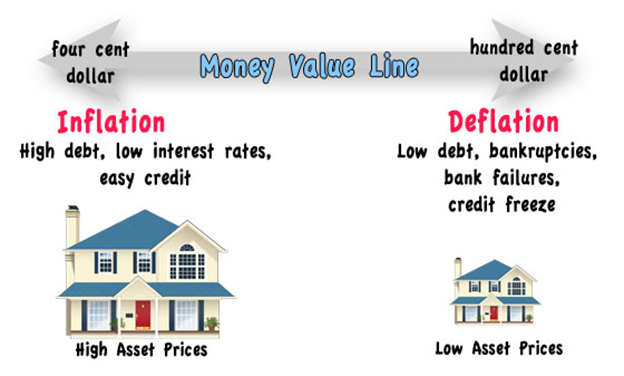

Inflation devalues our currency: A 1913-dollar bill is worth 4 cents today.

That’s why everything got more expensive over the last century. Our money became devalued.

Deflation is the opposite.

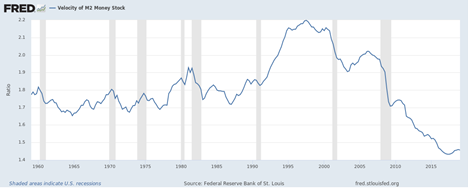

In deflation, a slowdown in lending — ongoing since 2007 — leads to less money in circulation.

Plus, if demand for a currency increases — as I expect to be the case with the U.S. dollar as it becomes more of a “safe haven” for global investors … the currency becomes worth more.

It’s basic Econ 101.

Lower prices in a deflationary environment are great for consumers with lots of cash.

But if you have lots of debt? Not so great.

Because you’re paying back those loans with money that’s worth more than when you took out the loan.

But here’s what makes the situation particularly scary:

Something inappropriately named The Federal Reserve.

(It’s not federal, as it’s privately owned. And it keeps no money in reserve.)

America’s central bank — and the other central banks around the world — have created a debt bubble larger than any other in history.

And that’s why the Fed will inevitably be forced to inflate the currency … to pay off the massive debt it’s created with cheaper dollars.

Central banks try to manipulate the economy. But Mother Nature always wins. Our ancestors were humble enough to know that.

So, you might be wondering …

How do you prepare for the coming deflation?

One possibility to guard your hard-earned money is with gold and silver-related assets.

In fact, if you haven’t already, be sure to check out my recent presentation where I show how you can make up to 100 times the potential profits you could make in bullion alone. So, be sure to watch it now before it goes offline tomorrow.

All the best,

Sean