Is the Rally in Pot Stocks Worth Playing? Heck, Yeah!

I want to show you how to play the rally we are seeing in cannabis stocks.

A rally? In cannabis?

Yes, you heard that right. After a tough 2019, with many pot stocks left beaten and bloody in the streets, 2020 is shaping up to be better.

Last week was excellent for cannabis companies. The future looks brighter.

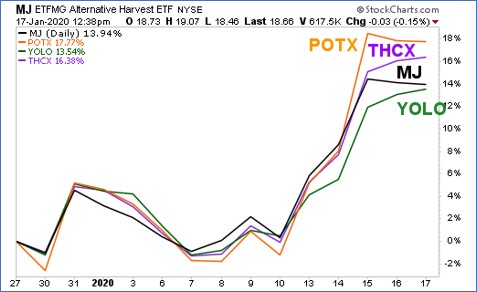

Here’s a chart of the ETFMG Alternative Harvest ETF (NYSE: MJ). This is the world’s largest ETF focused on the cannabis industry. And, thanks to its U.S. listing, it’s an easy way for Americans to play the rally.

You can see that MJ pushed above its downtrend, which I’ve marked as 1. It also bolted up through its 50-day moving average, which I’ve marked as 2. The 50-day moving average tracks the intermediate trend. That trend is now going higher.

MJ is pulling back a bit, but that’s okay. Nothing travels in a straight line. This kind of breakout gives us a price target of $24.50. That’s a gain of about 30% from recent prices. Not too shabby.

Interestingly, while MJ is a U.S.-based fund, its biggest holdings are Canadian — Canopy Growth (NYSE: CGC), Cronos Group (Nasdaq: CRON) and Tilray (Nasdaq: TLRY). In fact, 46% of MJ’s top holdings are Canadian.

Will this rally continue? I believe so. I gave you a bunch of reasons why on Thursday. Let me add to that …

- Multiple cannabis companies reported strong fourth-quarter numbers.

- Illinois just legalized recreational cannabis, and more states are on the way.

- The vaping crisis that cast a pall over the industry has gone up in smoke, with illegal vapes picked out squarely as the culprit.

- Investors are recognizing that many of these beaten-down stocks are downright values.

- Margins are improving. Revenue at the good companies is ramping up. Eventually, the better companies will turn the corner into big and bigger profits.

But MJ isn’t the only way to play this move. Let me tell you about three more …

- The Global X Cannabis ETF (Nasdaq: POTX). This fund, which started trading in September, is even more Canadian — 81.7%. U.S. stocks only account for 10.3% of its holding. But Canada is a country where cannabis is federally legal. The U.S. can’t say that. Not yet.

- AdvisorShares Pure Cannabis ETF (NYSE: YOLO). This fund splits its investments about equally between the U.S. and Canada.

- The Cannabis ETF (NYSE: THCX). It started trading in July. Canadian assets account for 62% of this fund, while U.S. stocks account for 24%.

There are other U.S.-listed pot funds, but the daily volume really starts to drop off. And even more important than getting into a trade is being able to get out.

So, let’s see how these three upstarts compare to Big Daddy MJ. We’ll track them from the beginning of the year.

You can see the funds are doing kinda the same, but there are leaders and laggards. The two that are leading — POTX and THCX — have the highest percentage of Canadian cannabis stocks. The two that are following, MJ and YOLO — have the lowest percentage of Canadian stocks. They hold more American pot stocks.

Why is this happening? Canadian cannabis stocks were sold down into the cellar. So, they were coiled tighter and bounced harder when the rally came.

The question is, where will outperformance come from going forward? I have some thoughts on that.

If you want to get more insight from me on cannabis stocks, consider attending the Orlando MoneyShow. I’ll be running the cannabis track at the MoneyShow on Feb. 6.

It’s a great city, a great conference and this is a GREAT time to be looking at beaten-down cannabis picks. Some are growing revenues hand over fist. AND earnings, too.

They’ve been dumped by an impatient market. The time to make the big, BIG gains is coming up.

All the best,

Sean