The One Chart That Shows EV Sales Will Shift Into Overdrive

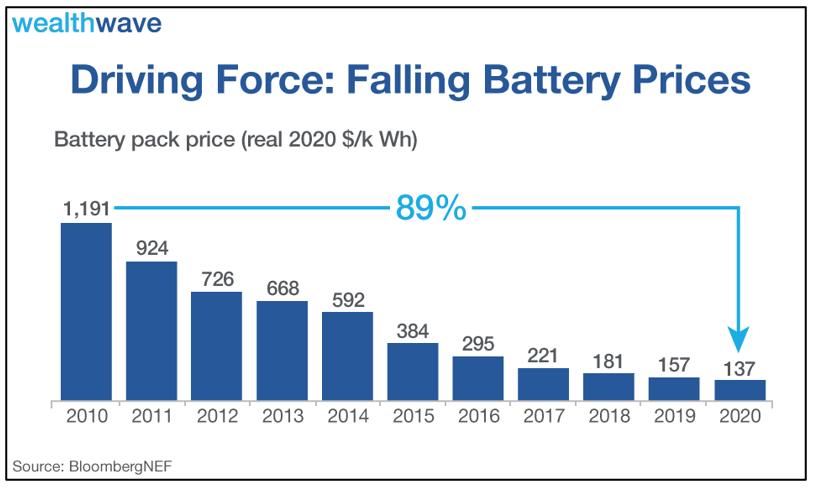

Here’s a chart for you. It shows what’s happened to the price of electric vehicle (EV) batteries over the past decade.

And in a way, it’s a road map to the future of the EV megatrend.

The battery is the most important part of any EV. On average, battery prices fell 13% from 2019 to 2020, and the past decade shows that the price has fallen 89%. And this is steering EVs headlong into price parity with internal combustion engine (ICE) vehicles.

In short, this chart shows us the ICE age is nearly over. The EV age is upon us.

What do I mean by “price parity?” That’s the point at which an automaker can theoretically build and sell an EV with the same margin as a comparable ICE vehicle without government subsidies for either one.

If you talk to three people about the future of EVs, you’ll probably get three different opinions. But generally, experts say that $60 per kilowatt hour (kWh) is probably the line where EVs will become cheaper than ICE vehicles around the globe.

Bloomberg New Energy Finance, the source of the chart above, expects battery prices to reach $80/kWh in 2026 and $60/kWh in 2029, down from $137/kWh in 2020.

And if you figure in all costs, it might come sooner than that. A new study from the U.S. Department of Energy (DOE) found that the maintenance costs of battery EVs are 40% lower than ICE vehicles.

Then there’s the cost of your own time to bring the car into the shop.

Cathie Wood’s ARK Investment Management says that if you add up the savings on fuel, maintenance, insurance and resale value, EVs are already cheaper to own than some gasoline-powered cars. According to ARK, we could see price parity as soon as the end of 2023.

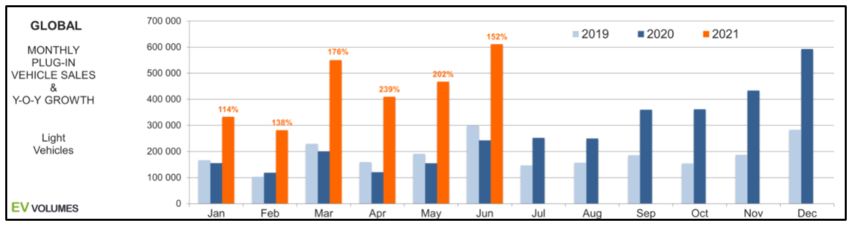

EV sales are still tiny as a percentage of total global sales — 3.24 million units, or 3.2% of total car sales last year. This year, in just the first half of 2021, 2.65 million new EVs were sold. That’s an increase of 168% over 2021!

To paraphrase Curly from the movie “City Slickers,” the year ain’t over yet.

And here’s a funny thing: The faster and more EVs sell, the faster prices will drop.

That’s due to economies of scale. In the last century, legendary aircraft engineer Theodore Wright came up with Wright’s Law, also known as the learning curve effect. He found that every time aircraft production doubled, labor time and costs fell by 20%.

Fast-forward and applied to the EV megatrend, lithium-ion (Li-ion) battery cell costs fall by 28% for every cumulative doubling of units produced.

You’ve seen that prices of new cars are rising, right? In fact, the average price of a new car jumped 5.4% in May, year over year.

Well …

• General Motors (NYSE:GM) LOWERED the price of the Chevy Volt by more than $21,000 from last year’s model. Why? The cost of battery technology fell.

• Ford (NYSE: F) announced that its electric F-150 Lightning would start at a similar price in the U.S. to the traditional F-150, even though the manufacturing cost is likely still higher. By the way, Ford just announced it was doubling its production target on the electric F-150 due to strong pre-launch demand.

• Tesla (Nasdaq: TSLA) and Volkswagen (OTCPK: VWAGY) have openly discussed driving the price of an EV battery down to $60/kWh, and how that would make the total cost of ownership of an EV average 26 cents per mile. That’s less than 27 cents per mile for the average ICE vehicle, according to the DOE’s Office of Vehicle Technologies.

Bottom line: The future is coming fast. And it may be upon us sooner than you think!

How You Can Play This

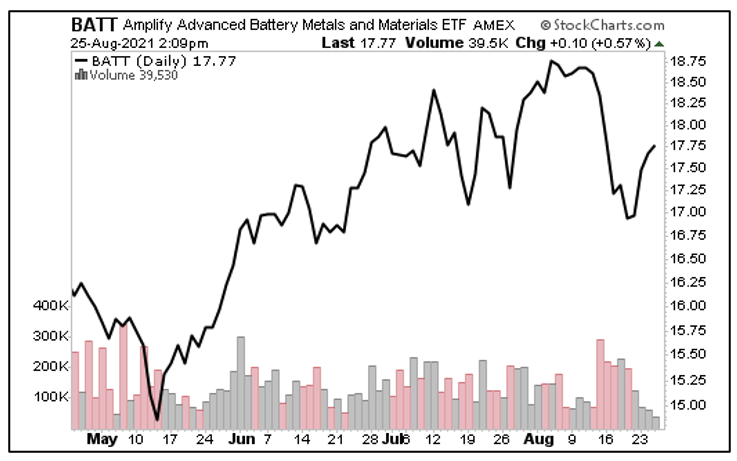

I just gave a presentation for the MoneyShow on battery metals. One of the exchange-trade funds (ETFs) I talked about was the Amplify Lithium & Battery Technology ETF (NYSE: BATT).

The fund holds a wider range of clean energy and alternative technology stocks, and its top three holdings are Tesla, Contemporary Amperex Technology and BHP Group (NYSE: BHP). About 35% of its holdings are in China. And it has an expense ratio of 0.59%.

You can see this ETF was on a massive rally until recently … that’s when Beijing cracked down on Chinese tech stocks, sending that market reeling.

But battery tech stocks aren’t the ones experiencing the crackdown — they’re just suffering in sympathy. And you know what that means? It’s a buying opportunity.

Savvy investors should strongly consider picking it up.

All the best,

Sean