Every major crisis in history drives short-term measures that turn into fundamental changes that last for generations:

- The Great Depression redefined the role of the government in the financial system. Those who lived through that rough time — perhaps many of our parents —pinched pennies for the rest of their lives.

- World War II and the rise of the military-industrial complex boosted manufacturing, entrepreneurship and the consumer society.

- 9/11 elevated the role of security for national infrastructure, leading to travel, cyberspace and governmental surveillance measures that continue to this day.

- The Great Recession hastened the shift from “ownership” to the “experience” economy.

And COVID-19 is accelerating trends like online learning, working from home, video communication and delivery services in the “shut-in” economy …

… behaviors that will remain embedded in our daily lives for years to come.

Last week, we saw how manufacturers have been impacted by supply chain disruptions in the short-term.

Now, I want to look at how manufacturers will change how they do business in the long-term.

As office employees and knowledge workers shift to more remote work, manufacturing still requires people to be physically on-site. Operators run machines. Maintenance staff maintain and repair them. Vendors and contractors need site access to provide support.

But with social distancing, manufacturers could lose up to 50% of their on-site personnel.

That’s why we’re seeing a “virtual shift”: specialists connected remotely to guide and support the reduced “physical shift.”

And savvy investors — rather than “raging against the machine” — are taking note of this powerful trend by investing in robotics stocks as firms seek to socially distance a thinned-out labor force with lower-cost machines.

Three companies in particular: Rockwell Automation (NYSE: ROK, Rated “C”), Cognex (NASDAQ: CGNX, Rated “C”) and AGB Ltd. (NYSE: ABB, Rated “D+”) are likely to benefit from the renewed momentum toward automation.

Let’s take a closer look at each …

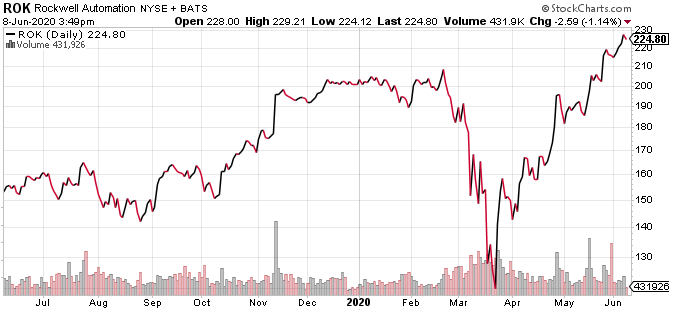

Rockwell Automation

Industrial automation, motion control solutions and digital transformation are ROK’s specialties via its software and hardware offerings …

… propelling the company to an expected 4% increase in sales in 2020, along with a potential 10% enhancement to its bottom line. As a bonus, dividends have skyrocketed nearly 70% over the past five years. ROK has nearly doubled in price since falling to $120 amidst the COVID-19 selloff.

Although pricey at more than $200 a share, its solutions will be much more in demand now that companies are challenged with performing production with as few human beings as possible.

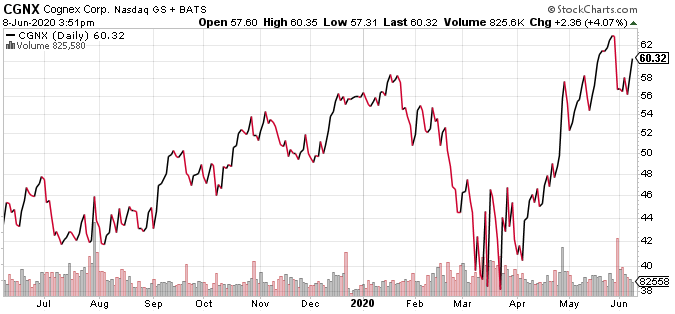

Cognex

It’s now possible to expedite a considerable part of the manufacturing process thanks to “machine vision” … and Cognex is at the vanguard of this technology.

Machine vision captures and analyzes visual information to automate manufacturing and track of items by locating, identifying, inspecting and measuring them during the manufacturing or distribution process.

Cognex is rated third out of 59 companies in the industrial–machinery space by POWR Ratings.

The stock is likely to build momentum as the economy reopens.

ABB Ltd.

ABB makes “total control” systems for food processors, car companies, materials businesses and a litany of other enterprises.

The sale of ABB’s power grid unit has hastened production of high-tech equipment including optical sensors and robots that assemble parts with remarkable accuracy and efficiency. This means ABB is poised to grow quickly.

ABB has an expected annual growth rate of 10.5% while its industry as a whole is expected to endure an earnings decline of 11.7%. With a forward P/E ratio slightly above 13, ABB provides an attractive combination of solid value and growth potential, making it a suitable candidate for just about every investor’s portfolio in 2020 and possibly for years to come.

This robotics and automations specialist is rapidly closing in on its pre-coronavirus high of $25 a share. Get onboard!

All the best,

Sean