The Fed sent investors a message on Tuesday, loud and clear: “We’re taking the coronavirus outbreak seriously.”

If you missed it, the Fed dropped a “surprise” emergency rate cut on the market on Tuesday. I put surprise in quotes because the cut was widely anticipated by the market.

Rate cut anticipation sent the U.S. dollar down 2.6% going into Tuesday. And the dollar went down because the lower the interest rate on a currency, the less return investors get for holding it. So, it’s less attractive.

By way of justification, the Fed says it is trying to stay ahead of disruptions and economic slowdown caused by the rapidly spreading COVID-19.

Their thinking is, when interest rates fall, it’s cheaper to borrow money. When it’s cheaper to borrow, people and business take out more loans. They spend and invest some of that money, which drives economic growth.

This all makes sense. But none of it will deal with the current problem: Destruction of both supply and demand in China as factories shut down over fear of the virus spreading (though many are reopening).

The rate cut makes even less sense when you consider the fact that borrowing was slowing even before the coronavirus outbreak. And interest rates were already at all-time lows.

Whether or not the rate cuts will actually help, the action speaks pretty loudly. It says that the Fed is taking the volatility to the markets seriously.

At least, that’s what most investors hear. But you should also be listening to the second message. See, with its cut, the Fed is sending another message, too. Even though it may not realize it.

That message is: “Buy gold.”

How did I hear “buy gold” from “we’re cutting interest rates by 50 basis points”?

Well, let’s start with this chart. The 10-year U.S. Treasury yield fell below 1% intraday, going as low as 0.989%. That’s the first time this has happened. Ever!

How does this relate to gold? Well, one of the complaints about gold is it doesn’t pay interest. Now, you can pretty much say the same for a Treasury Bond. For 10 years! That makes gold much more attractive.

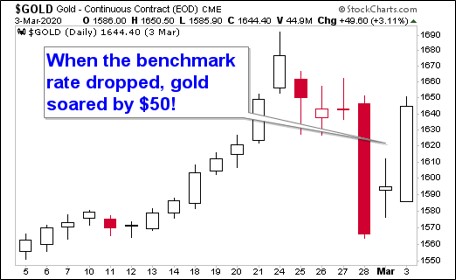

Falling bond yields boost gold prices. And you can tell that by what happened in the gold market on Tuesday …

When the Fed cut rates by 50 basis points, gold soared by nearly $50! That reversed much of the panic selling in gold we saw on Friday.

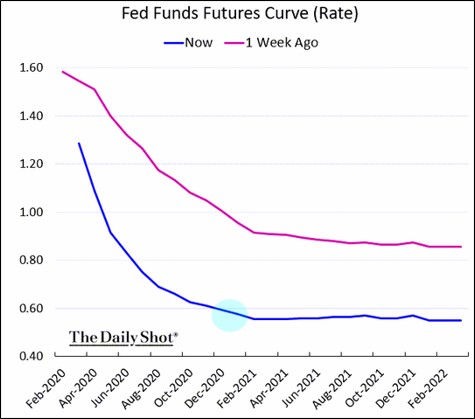

So, what’s going to happen going forward? More rate cuts! At least according to the futures market, as this chart from The Wall Street Journal’s Daily Shot shows.

The futures market was recently pricing in an 85% chance of another 50-basis point cut at this month’s FOMC meeting on March 18.

Fed governors have stepped forward to say that isn’t happening. But these same Fed governors also insist the Fed doesn’t buckle to political pressure. The cuts on Tuesday show otherwise.

And cuts should keep coming. The market expects the U.S. central bank to take the benchmark rate below 0.6% by early next year.

What’s that tell you? It’s simple, and I’ll say it again. Buy gold.

Even better, buy miners leveraged to gold. And you might consider buying SMALLER miners.

Miners are going higher in a new bull market. The entire market value of gold stocks globally is estimated at around $280 billion. In other words, the global gold industry could increase in market cap four times, and it still wouldn’t be worth what Apple, Inc.’s stock is worth today.

Funds are already moving into the big miners. But small-caps remain depressed after a seven-year-long bear market. Some of these companies are DIRT cheap.

But I don’t expect them to stay that way for long. That’s why we’re getting busy in Gold & Silver Trader.

If you’re doing this on your own, be very careful, and do your due diligence. But don’t sit out this rally. The Fed has all but put on a neon sign to higher gold prices. Take the hint. Get gold.

All the best,

Sean

P.S. The Fed’s rate cut means it’s taking COVID-19’s effects on the market seriously. Investors should follow suit.

Our founder, Dr. Martin Weiss, put together a FREE 10-minute video that breaks down how this outbreak is affecting the markets and how you should respond to maintain your financial health. If you haven’t seen it yet, I highly recommend you watch it here.