Robots have been replacing manufacturing jobs because of their long-term cost savings, and you can bet they’re here to stay.

I’ve talked about the rise of robots megatrend before … and COVID-19 has accelerated the shift from human to automated labor in addition to remote work.

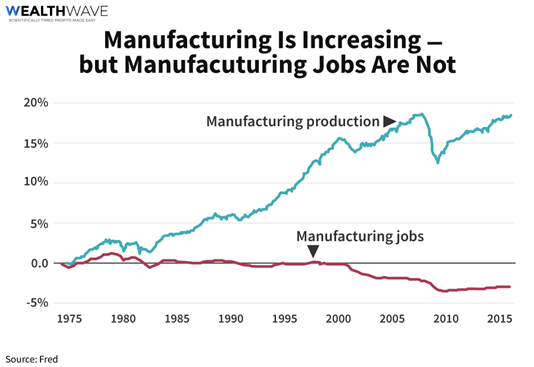

Over the last several decades, manufacturing production has become more efficient. This is no surprise as the number of technological advancements increased. At the same time, though, the amount of manufacturing jobs during this period of growth have declined.

Take a look at this chart. It shows that even with tremendous production growth, manufacturing jobs have been declining since the 1980s.

The biggest dips correspond with recessions, as we see these periods match up with the 2000 dot-com bubble and 2008 financial crisis.

While it’s important to note that manufacturing jobs took a hit with the production decline … the major takeaway is they never came back.

And we’ll see the same thing after the pandemic. During hard times, companies invest in workplace automation to reduce their payroll costs.

Companies had major supply chain issues during lockdowns, and they were forced to cut headcount. Many of those jobs are permanently lost.

Offshoring also plays a role in the historical reduction of U.S. manufacturing jobs, but only 13% of these losses can be blamed on sending them overseas.

The real answer is automation.

But automation will only take away from low-skill jobs, right?

Wrong.

Even some of the most highly-skilled professionals are at risk of having their jobs automated.

Take accountants for example. In 2020, nearly 185 million people filed tax returns using online software, or 89% of all individual filers. This is up from 50 million in 2014.

The same goes for doctors. In 2017, more people trafficked WebMD monthly than all U.S. doctors’ visits combined. A trend is solidifying, and we want to be on the right side of it.

Like with most trends, the smart thing to do is use them to your advantage … so here are three ways you can profit from the rise of robots and artificial intelligence:

Pick 1. ARK Autonomous Technology & Robotics ETF (BATS: ARKQ)

This actively managed ETF focuses on companies specializing in autonomous technology and robotics. It also looks to invest in areas leveraged to future innovation, such as energy storage and space exploration.

ARKQ’s top holdings include electric vehicle maker Tesla Inc. (Nasdaq: TSLA), Belgian 3D printer Materialise NV (Nasdaq: MTLS) and technology company Trimble Inc. (Nasdaq: TRMB).

Pick 2. Global X Robotics and Artificial Intelligence ETF (Nasdaq: BOTZ)

This ETF tracks the Global Robotics and Artificial Intelligence Thematic Index.

The main focus is on future adoption, so it offers exposure to companies that profit from the proliferation of AI.

BOTZ’s investments focus on a variety of functions ranging from industrial production to autonomous vehicles.

Top holdings include Japanese robotics company Fanuc Corp. (OTCMKTS: FANUY), medical robotics company Intuitive Surgical Inc. (Nasdaq: ISRG) and chip maker NVIDIA Corp. (Nasdaq: NVDA).

Pick 3. Robo Global Artificial Intelligence ETF (NYSEARCA: THNQ)

THNQ’s investments center around companies optimizing their business models using AI and machine learning. These investments span across healthcare, cloud computing, e-commerce and more.

The top three holdings in this AI-focused ETF are Chinese tech giant Baidu Inc. (Nasdaq: BIDU), biopharmaceutical company Intellia Therapeutics Inc. (Nasdaq: NTLA) and software company Varonis Systems Inc. (Nasdaq: VRNS).

Each of these ETFs highlight the importance of pioneering technology.

We’ll be ready to profit from it.

All the best,

Sean