This Tiny but Mighty Miner Could Ride the Gold Bull Run

Precious metals are giving back some gains this week. This is OK. It’s just the zig-zag of a normal bull market. The big trend is in our favor.

Besides, there are developments afoot that could kick gold into overdrive.

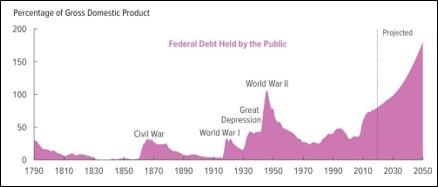

For example, in a development that should put fear into dollar bulls — and sparks in the eyes of gold bugs — the Congressional Budget Office said Tuesday that the national deficit and debt will rise above $1 trillion in 2020 and keep on rising.

Debt held by the public is projected to reach 98% of GDP by 2030.

And by 2030, the U.S. national debt is projected to rise to $31.4 trillion.

What do you want to bet that’s a low-ball estimate?

The pullback in gold that started this week is hammering mining stocks. There may be more downside to come.

But you also know that the next surge is coming. And it’s likely to be big.

When gold and mining stocks surge again, you might want to pick up a few tiny stocks. I’m not saying these should be the bulk of your portfolio. But tiny explorers can do extraordinarily well when the gold bull really starts to run wild.

Here’s an example of one I’m adding to my own portfolio:

Kore Mining (TSX-V: KORE) (OTCQB: KOREF). I recently talked to Scott Trebilcock, Kore Mining’s president and CEO. You can watch that video here:

Kore has a portfolio of excellent gold exploration properties in California and has secured funding to move forward on its main project, Imperial.

It has nearly 5 million ounces of gold in historic resources across three projects. Drilling this year will potentially prove some of that up.

The company also has a tight share structure, with just 99,271,414 shares fully diluted.

And it has some heavy-hitter investors, too: Macquarie Bank and Eric Sprott. Macquarie Bank invested $4 million to fund permitting of Imperial. And Sprott invested $3 million to fund exploration.

Top-notch management is very important to me, and KORE’s team has succeeded before. Management owns 50% of the company, so they’ve put their money where their mouths are.

As I said, I like Kore enough that I added it to my own portfolio. And you may want to keep it on your radar as well.

Because the next rally in gold is coming. And small, well-positioned explorers could ride that rally higher than most people can imagine.

There’s another way to get the most out of your investments. If fact, you can learn more by checking out this video call recording featuring Martin Weiss and my colleague Jay Livingston. In it, they’ll explain how you could possibly take home $1,000 every Friday.

It’s well worth a few minutes of your time! Click here to watch it before we take it offline.

All the best,

Sean