The Two Industries Being Hit Hardest by COVID-19 Are …

The market enjoyed a great rally yesterday as the spread of COVID-19 cases showed signs of flattening out in the hardest-hit area: New York City. But big rallies are part and parcel of any bear market. And if you want to know what many bears are thinking: “Let this market rally further.”

So, sure, the rally could continue, riding higher on floods of money from the Fed, the Treasury and bipartisan bills in Congress. And if it does, it will get up to where bears will want to short it again.

But make no mistake, the next week or two will be difficult ones:

“This is going to be our Pearl Harbor moment, our 9/11 moment, only it’s not going to be localized, it’s going to be happening all over the country and I want America to understand that,” Vice Admiral Jerome Adams said on “Fox News Sunday.”

So, if stocks do rally, what will you want to sell at the next top? I have a couple ideas.

Airlines

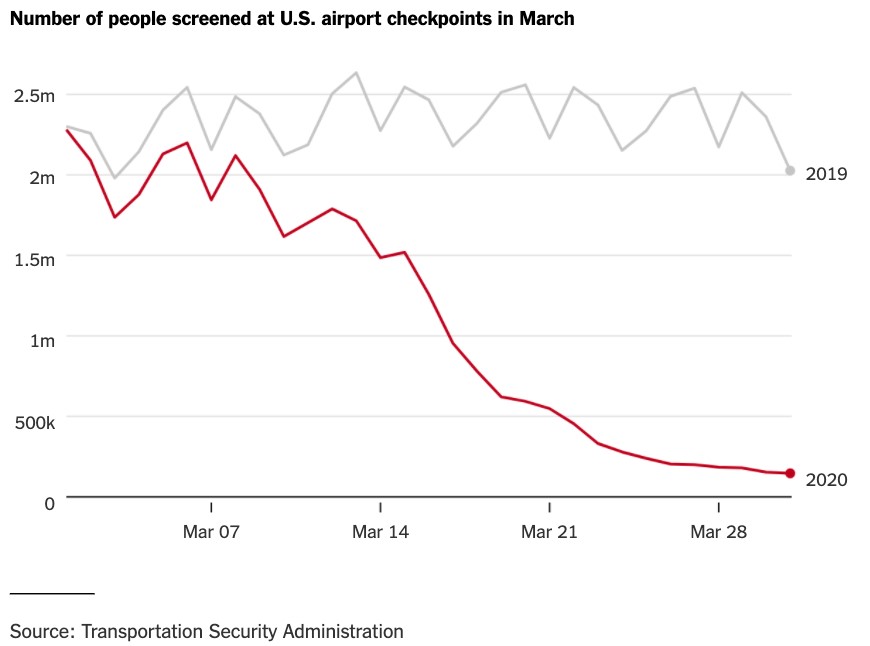

As the coronavirus spread around the world and governments enacted travel bans and closed borders, demand for flights quickly collapsed. On March 31, only 146,000 people streamed past TSA checkpoints, which is about 7% of the 2 million people screened on the same day last year.

The industry is facing an unprecedented demand shock.

In a best-case scenario, air traffic collapses by 90% in the second quarter, declines by 55% in the third quarter and by 30% in the fourth quarter, compared to 2019 levels.

The passage of the Coronavirus Aid, Relief and Economic Security (CARES) Act provides up to $50 billion to airlines to keep them afloat and keep their employees on the job. This has investors feeling better about the industry.

However, their optimism is likely misplaced.

Those airlines may be forced to liquidate billions of dollars of assets, such as planes, equipment, aircraft leases, flight slots and gates. They may then need to tap other sources of capital.

One way to mitigate these issues is by monetizing their mileage programs. But, Stifel analyst Joseph DeNardi writes, “If airlines start seriously talking about mileage presales, we’ll know things are particularly dire.”

American Airlines Group (Nasdaq: AAL) looks to be in the most dire straits of them all.

The company ballooned its debt load to modernize its fleet and wound up retiring planes that were far from needing replacement. This resulted in American becoming the most debt-burdened company in the airline industry, with up to $30 billion in net debt. This is a deep hole to dig itself out of.

American will likely emerge as a smaller airline. That could benefit carriers with broad exposure to American’s routes, like Southwest (NYSE: LUV), Allegiant (Nasdaq: ALGT), and Spirit Airlines (NYSE: SAVE). Alaska Airlines (NYSE: ALK) could get a bounce from a recovery in the tech industry due to the carrier’s west coast focus.

Delta (NYSE: DAL) should also be a long-term winner as it’s one of the highest quality carriers in terms of financial strength and routes.

Given this information, it’s unclear what the near-term holds. Bernstein analyst David Vernon estimated that American and United can survive for only two months before running out of cash … while Delta and Southwest could last for five and eight months, respectively.

Cruise Lines

Trouble in the cruise industry started with one confirmed case of the novel coronavirus on Carnival’s Diamond Princess. From that came a torrential wave, resulting in 712 cases and 10 deaths. The ship was left stranded for weeks as the Japanese government tried to figure out what to do.

Being stuck in a floating prison isn’t exactly a great marketing message.

Cruise ships are virtual petri dishes for contagious diseases. The Diamond Princess suffered an infection density even higher than the pandemic’s epicenter in Wuhan China.

Wall Street darlings like Royal Caribbean (NYSE: RCL), Carnival Cruises (NYSE: CCL) and Norwegian Cruise Line Holdings (NYSE: NCLH) are sinking into the abyss as coronavirus fears strike at the soul of this once buoyant business.

Like all pandemics, this one will eventually fade away. But the scars it leaves on the cruise industry may never fully heal.

Unlike airlines, which provide a far more necessary service, cruises are highly discretionary. Sure, they’re a boatload of fun — when you’re not in forced quarantine. But people can survive without the experience.

And even before COVID-19, cruise ships were already vulnerable to noroviruses. This virus also spreads quickly, potentially giving the industry another black eye in a post-coronavirus world.

All this red ink has attracted contrarians looking for a once-in-a-lifetime discount. While I admire their bravery, you need to recognize that we’re in uncharted territory. Caution — not contrarianism — is the smarter approach here.

All the best,

Sean