U.S. Squares Off Against China Over the Metals of the Future

Who doesn’t like free government money? Heck, Wall Street sure does.

Well, Washington, D.C. is ready to point its free money cannons at anyone who can help loosen China’s stranglehold on rare earths.

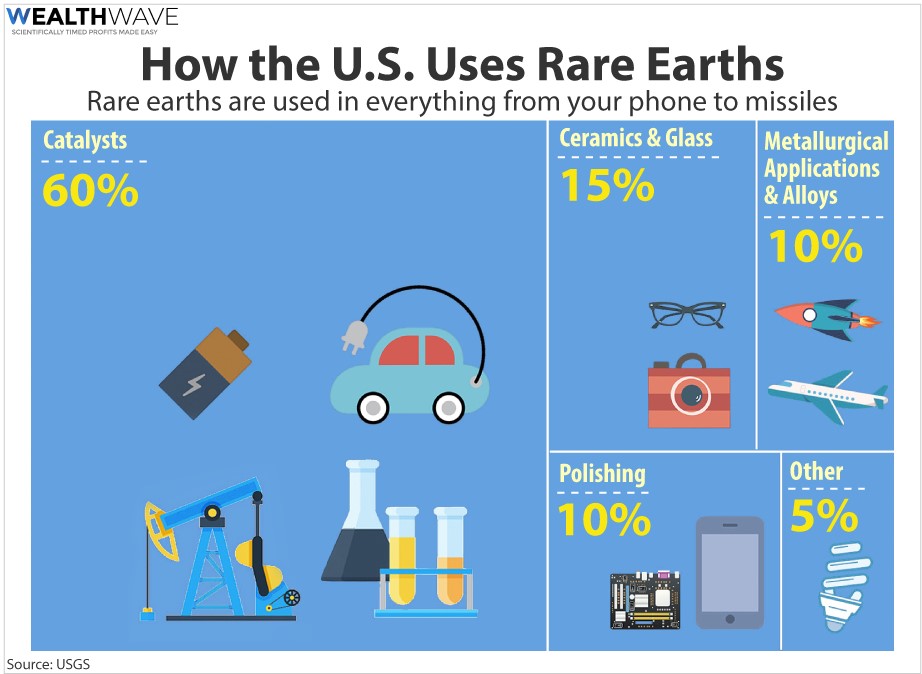

Rare earths elements (REEs), metals and their alloys are indispensable in all sorts of devices — from your cell phone to electric vehicles to the latest military missiles.

Rare earths aren’t particularly rare in the Earth’s crust, but deposits that are big enough or rich enough to mine economically are hard to find. For one thing, you have to compete with mines in China, which have laughable safety standards and some of the cheapest labor on Earth.

China’s Big Plan

China spent the past 30 years cementing its stranglehold on the world’s rare earths. Now, it controls 80% of the world’s supply. And according to a report from Horizon Advisory, “China’s rare earths positioning both implicates and threatens the entire global system.”

And this is leverage the Chinese WILL use. As China-U.S. trade relations hit the skids last year, China’s President Xi Jinping toured a region of China called “the rare-earths kingdom.” The trip was seen as a blunt message to the U.S. that China has leverage over high-technology industries, ones that are critical to America’s economy.

Now, finally, the U.S. Department of Defense is rightly freaking out about that.

It’s cheesed off because REEs are essential to many critical weapon systems, including precision guided munitions (PGMs), lasers, radar, sonar, night vision systems, jet engines and armored vehicles.

So, last year, President Trump authorized the use of the Defense Production Act to strengthen America’s domestic industrial base and supply chain for REEs. Also last year, the U.S. Army announced it would fund construction of rare earths processing facilities.

Fire the Money Cannons!

A rare earth processing pilot plant could cost between $5 million and $20 million, depending on location, size and other factors, with a full-scale plant potentially costing more than $100 million to build. That’s where the free money comes in. Some government contract materials published online say grants through these programs offer between $5 million and $20 million.

One test project is already underway in Wyoming, where the Department of Energy gave a federal grant to create a pilot-scale production facility to demonstrate the economically viable production of rare earth elements from coal-related feedstocks that are rich in rare earths. In other words, coal and coal ash, which Wyoming has plenty of.

The Department of Defense is also helping pay for a processing facility at the Mountain Pass Mine in California, America’s only domestic mine focused on rare earths. Mountain Pass is controlled by a hedge fund, JHL Capital.

The Department of Defense is also providing grant funding to Australia’s Lynas Corp. (OTC Pink: LYSCF, Unrated) and its partner, the privately held U.S. chemical company Blue Line Corp. These companies want to build a plant in Texas.

There’s more of that sweet government cash flow to go around. Recently, I talked to a company that thinks it has just the right-sized bucket.

A Tiny Company with Big Plans

Medallion Resources (OTC Pink: MLLOF / TSX-V: MDL, Rated D) is not a miner, but it has a patented process that could provide rare earths cheaply. I know all this from talking to Mark Saxon, President and CEO of the company. Also on the call was Don Lay, a director of this tiny company with a $5 million market cap.

Medallion’s plan involves a substance called monzanite.

Monazite is a phosphate mineral containing 60% rare earths. Monazite is available as a by-product from North American, Australian and African heavy mineral-sands operators. Medallion’s plan is to source rare-earth mineral available as a by-product from current mining operations or existing stockpiles.

Couldn’t anyone do that? Well, Medallion has developed a special process that it says will give it a leg up on the competition. Here’s a slide from the company’s presentation.

You can see that along with REE concentrate, uranium, thorium, radium waste and even other substances are also produced by this process. So, not anyone can do it. And you need to locate in a state and town which is open to this kind of industrial activity.

Medallion just did a cash raise and is making plans to build a pilot plant right now. At the same time, the company says it is fielding inquiries from the U.S. Department of Defense about this process. And Medallion’s execs are also in talk with potential suppliers of monazite. It expects to finance its pilot plant by the fourth quarter.

Remember, Medallion is not a miner — it’s a processor. It could start building that plant next year. So, this could be really exciting.

Medallion only has 70 million shares fully diluted. Let’s take a look at the daily chart …

The stock is ramping up and looking good. The word of caution is “if” — a lot of what Medallion hopes to do is predicated on government money, raising of other funds, the success of the pilot plant and more. But that’s not surprising. Early stage investments carry more risk AND reward.

The OTC Pink Sheets can be dreadfully thin in volume. I would prefer to wait for this stock to uplist before I nibble at it. But investors and traders with a stomach for risk and potential reward may not wait.

If you prefer less risk, there is the VanEck Vectors Rare Earth/Strategic Metals ETF (NYSE: REMX, Rated C+). Just be aware that funds don’t have “knock it out of the ballpark” potential.

Rare earths can rightly be called the metals of the future. Let’s hope the U.S. didn’t wait too long to get into the race.

All the best,

Sean

P.S. Rare earths may be the next big thing, but gold and silver are already on the boil! In fact, I’m giving a special presentation online for The MoneyShow. And it includes red-hot picks in gold and silver miners and explorers. This special event is on July 8. You can find out more by CLICKING HERE. It’s free! I hope to talk to you then.