About seven weeks ago, I gave you my bullish outlook on uranium. Since then, things have only gotten MORE bullish. The white-hot metal is powering up. There is profit potential galore. Let’s take a look at a few charts, shall we? Why, I even have an investment idea or two.

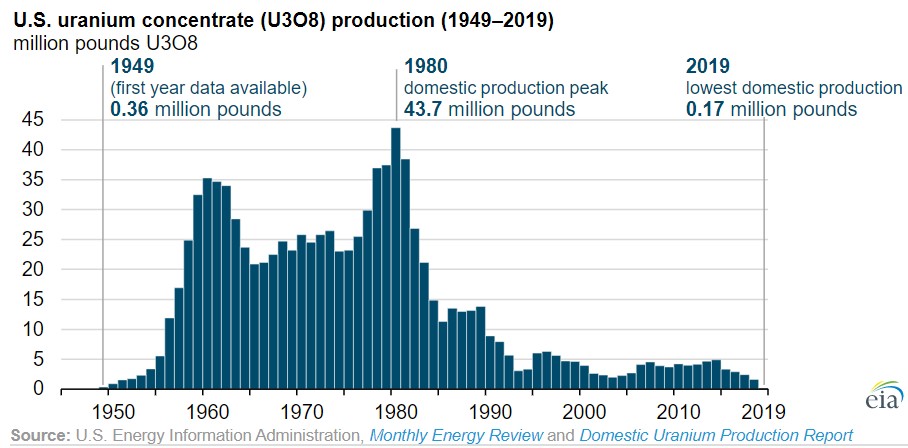

First, we have a brand-spankin’ new chart from the Energy Information Administration. It just came out Thursday and it shows America’s year-over-year uranium production chart.

The U.S. produced 174,000 pounds of uranium concentrate (U3O8) in 2019. That’s an 89% decrease in one year! And it’s also the lowest production since the EIA started keeping records in 1949.

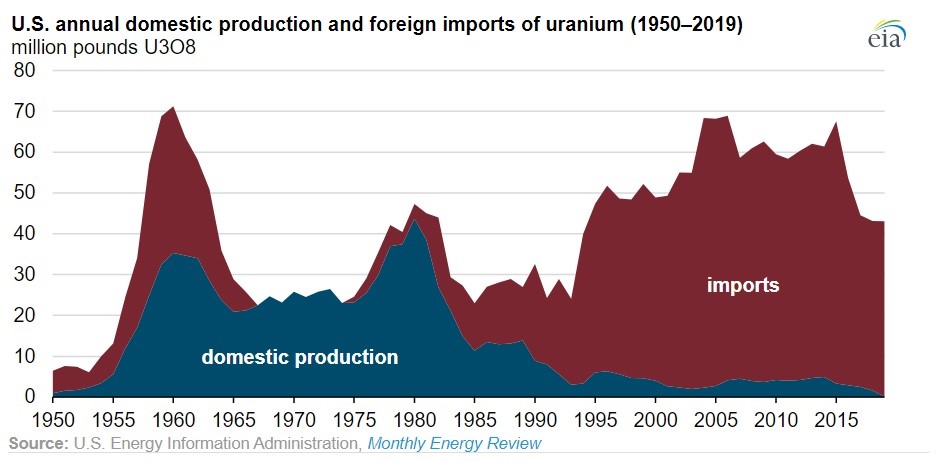

When you have less supply of something, prices usually go up. To be sure, the U.S. can import more uranium from overseas …

The problem is, we already import so much. AND, to make matters worse, the COVID-19 pandemic is forcing shutdowns of uranium mines around the world. Mines that have shut down in recent months include Olympic Dam in Australia, Cigar Lake and McArthur River in Canada, and state-run mines in Kazakhstan.

Well, those shutdowns will just be temporary, right? Sure. But reopenings can be temporary as well. Kazakhstan normally produces about 40% of the world’s uranium. It reopened its mines, only to have to shut them down again due to ANOTHER surge in COVID-19 cases across the country.

Heck, looking at total world supply, COVID-19-related uranium supply destruction was estimated at 20 million pounds in April, then jumped to 30 million pounds due to extended suspensions. And if things continue to go wrong, we might see 50 million pounds of supply suppressed by the end of the year.

The bottom line is that even if all those mines came back online, we’d still face a supply/demand deficit of 35 million pounds a year, ballooning to 400 million pounds by 2030.

Why is that? Because uranium has been so cheap, for so long, that no one had any incentive to build a mine. Meanwhile, countries around the world, led by China, are building a lot more nuclear power plants.

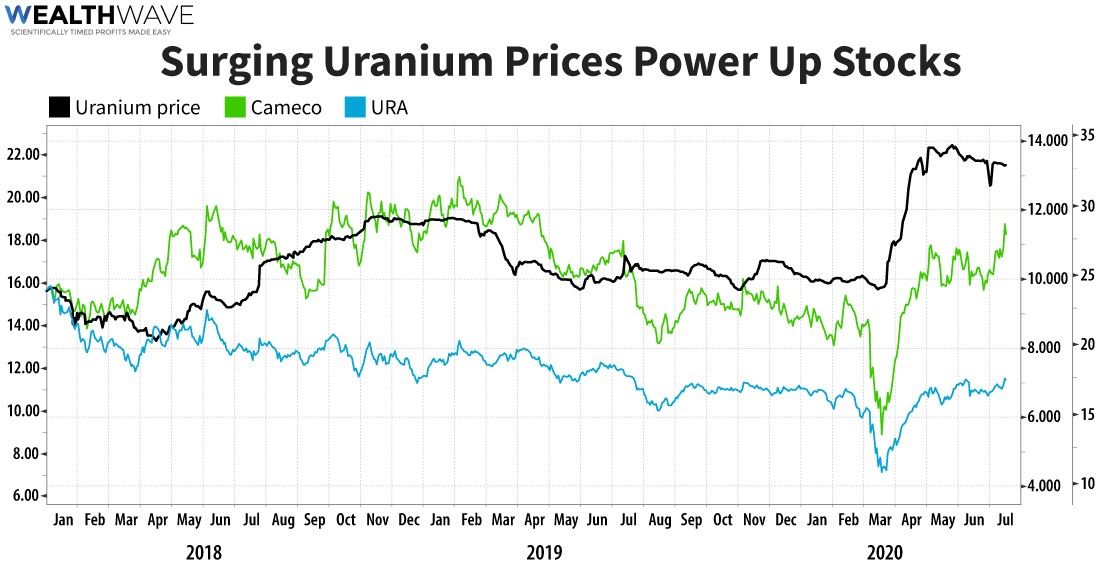

Now for some good news. Less supply IS lighting a fire under the price of uranium. And that’s breathing some life into uranium stocks.

Take a gander at this next chart …

The black line is the price of uranium. You can see that it went ballistic in March as the COVID-19-related mine shut-downs started to bite. Recently, uranium was up 36.7% from its March lows.

The blue line is Global X Uranium ETF (NYSE: URA, Rated D). It holds a basket of uranium miners, as well as companies that make nuclear components, and others in the industry. It’s up 63% from its March lows. It’s the old story of miners being leveraged to the underlying metal.

The green line is Cameco (NYSE: CCJ, Rated D+). This is a pure uranium miner. It’s up 106% since the March lows — even though it has shut down its mines.

Why is it up when it shut down its mines? Well, it still has stockpiles of uranium to sell into an increasingly undersupplied market. Also, investors know that Cameco will turn its mines back on again, eventually.

When will that be? We’ll have to see how the pandemic plays out. By then, I expect uranium will be at much higher prices. And uranium miners, too.

You can’t by uranium, but you can buy Uranium Participation Corporation (OTC Pink: URPTF, Rated “D+”). That’s a fund that holds physical uranium hexafluoride gas and tracks the metal pretty closely. Or you can buy Cameco — my Supercycle Investor subscribers already did, and they’re doing well — or you can buy URA.

But for Pete’s sake, don’t let this megatrend pass you by. Uranium is powering up. The white-hot metal is going to get hotter. Soon, it could melt up! Higher prices are ahead.

All the best,

Sean