The War Cycle is Bullish for Gold. You Should Be, Too

It looked like America was at the brink of war with Iran, with missiles flying in both directions. As fear spread, gold surged to a seven-year high. Then the two nations stepped back. “Iran appears to be standing down, which is a good thing for all parties concerned,” President Trump said.

My take: Don’t breathe easy just yet. There are powerful forces at work that are increasing the likelihood of more armed conflict. And there may be little President Trump can do to stop it.

The good news, if there is any, is that the “peace is breaking out” announcement sent gold lower. And this gives you an opportunity to load up before the next big surge higher.

Why do I think gold will go higher? It’s affected by the War Cycle.

I’ll explain what the War Cycle is in just a bit.

America’s face-off with Iran is arguably the most serious geopolitical development in many years. But traders believe that things in the Middle East will continue to calm down. And that gold prices will slump even lower.

I’m expecting a pullback … one worth buying. Because of something that isn’t even on the radar of Wall Street traders. Something that could send gold SOARING.

I’m talking about the War Cycle. This is something that Weiss Ratings has tracked for years.

Related post: Arm Yourself with This Defense ETF

While wars can appear to be triggered by random events — like the assassination of Archduke Ferdinand before World War I — the truth is they’re the result of social and economic forces that build up over time.

Historians and social scientists have studied these forces for hundreds of years. But in the last century, a few mathematicians, cultural anthropologists and sociologists have noticed something:

There is a regular pattern to the outbreak of war.

In fact, the social and economic patterns that make war likely are almost as predictable as the movement of the sun across the sky, or the changing of the seasons.

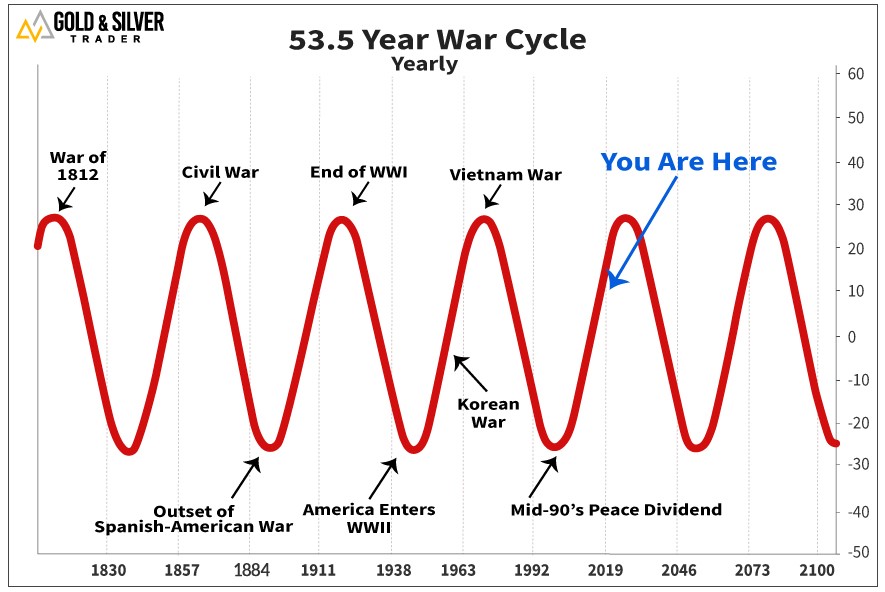

Two war cycles repeat themselves consistently: a 17.71-year cycle and an 8.8-year cycle.

These, in turn, are sub-cycles within a larger 53.5-year cycle.

This 53.5-year cycle is what I call it the “Granddaddy of War Cycles.”

All three of these proven war cycles — the 53.5-year cycle, 17.7-year cycle and the 8.8-year cycle — are converging in a way that hasn’t happened in at least 50 years!

This chart maps it out for you …

What this cycle shows is a visual representation of human nature. Tensions build up, conflicts erupt, peace comes, then tensions build up again.

And that means we can only expect things to get worse before they get better.

That, in turn, should mean higher gold prices. That’s because gold is the ultimate safe haven. It’s what investors rush to when fear grips the market.

And that’s just ONE of the forces lining up to push gold higher. For more, you can read my column on Jan. 4.

In press reports, Edward Moya, a senior market analyst for investment firm Oanda, said: “Investors have not priced in the chance of a full, blown-out war in the Middle East … gold will remain the favorite safe-haven trade.”

In my publication Gold & Silver Trader, we’re already making the most of gold’s rally. And I’m ready to pull the trigger on more picks when we get to the next buying opportunity. (If you want to join us for specific “Buy”/“Sell” recommendations, click here.)

I’d like to buy on a pullback. We can pick our entry points.

If you’re doing this on your own, you can position yourself in the SPDR Gold Shares (NYSE: GLD). And the VanEck Vectors Gold Miners ETF (NYSE: GDX) tracks a basket of miners that are leveraged to the price of the metal.

But there are better picks — individual stocks that will roar higher. As the War Cycle shifts into higher gear, those individual gold miners should give you the most bang for your buck.

All the best,

Sean

P.S. In this time of uncertainty, ensuring your investments are working hard for you is essential. But doing so is tricky and time-consuming.

That’s why Dr. Martin Weiss and the team at Weiss Ratings has done the hard work for you. We’ve conducted over 500 case studies and have reached the biggest breakthrough in Weiss’ 48-year history:

A safe, income-generating machine that anyone can use.

We’re revealing the secrets behind this explosive secret this coming Tuesday, Jan. 14 at 2 p.m. Eastern in our first-ever Instant Income Webinar. Click here to reserve your seat and take the first step in generating more income from your investments.