Gold continues to power higher.

In the short term, it’s fear of the Coronavirus. But this “Asian contagion” just masks deeper fundamentals lining up to power gold higher.

I think we can all agree that gold is in a bull market. That seems apparent. While other investments are crumbling as traders run for cover, gold powers higher.

Indeed, its latest breakout gives us a target of $1,800, if the previous breakout is a guide.

You can see that gold is breaking out of a bull flag pattern. This is one of the strongest bullish patterns there is. A previous bull flag formed from February to May last year. The breakout sent gold soaring 24% in 15 weeks.

Now, we’ve seen gold break out again. It’s only made a 9% move so far. The old saying on Wall Street is that “flags fly at half-mast.” If that holds true, that gives us a target of at least $1,800 on the yellow metal.

So, is it too late to buy? Not by a long shot. Pullbacks can be bought.

Smart Investors Are Buying

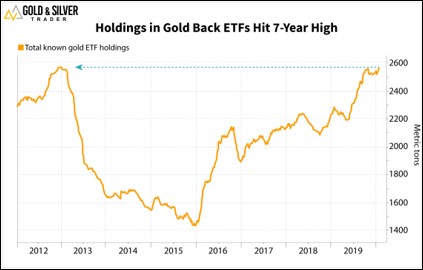

Let me show you another chart. This is a chart of holdings in ETFs backed by physical gold …

Worldwide, holdings in gold-backed ETFs rose to 2,561.2 metric tons as of Tuesday. That’s the highest level since January 2013.

This tells us that retailer investors and institutions see very good reasons to own the physical metal. This isn’t a trend likely to soon.

But can you blame them? They’re just following the examples of the world’s central banks.

Central Bank Shenanigans

Central banks bought gold at a record pace in 2019. Global reserves grew by 684 metric tons. Only 2018 saw bigger purchases, a record that stretches back 50 years!

2019 also marked the 10th year in a row that central banks were net buyers of gold.

Why are they buying? Probably because central banks are in the best seat to see how fast they are running the printing presses on fiat currency. They know, in their bones, that they’ll need something to back it up when the you-know-what hits the fan. As it inevitably will.

And this isn’t the only sign of stress. The amount of negative-yielding government debt is climbing again. After surging to $17 trillion last August, the amount of negative-yielding debt slowly ebbed to $10 trillion.

Many thought the coast was clear. Now, the amount of negative-yielding debt has climbed to more than $13 trillion worth in a matter of a few weeks.

With negative-yielding debt, if you buy one of a country’s 10-year bonds, at maturity, you get back less money than you paid for it.

In other words, you are guaranteed to lose money.

But for many deep-pocketed, presumably well-connected investors, it is preferable to alternative investments.

Are you worried yet? You should be!

And typically, as I’ve pointed out in previous articles, when the amount of negative yielding debt climbs, the price of gold climbs along with it.

Supply/Demand Squeeze

More fundamentally, there is a good ol’ fashioned supply-demand squeeze brewing in gold. Total gold supplied by the world’s mines fell 1% last year, to 3,464 metric tons, according to data from the World Gold Council. That was the first year-over-year decline since 2008!

In China, the world’s largest producer, mine output fell 6% year-over-year in 2019. That’s the third consecutive year of decline. China is also the world’s largest consumer of gold. India runs a close second.

But they can just mine more, right?

Wrong! It takes years to bring a mine online. And one mining project after another was shelved during years of low gold prices.

Plus, there’s the fact that high-grade, easy-to-mine projects are very rare these days. Heck, miners are now going after gold deposits they once drove over to get to the good stuff. That good stuff is now mined out.

So yeah, gold production will go down for the foreseeable future. And when supply goes down, prices usually go up.

So how should you play this? My Gold & Silver Trader subscribers are doing very well in individual stocks. I plan to give them more picks soon. On the next pullback.

If you’re doing this on your own, you’ll have to roll up your sleeves and do a LOT of research. There are gold stocks out there I wouldn’t touch with anybody’s money.

Or, if you want a quicker solution, you can buy the VanEck Vectors Junior Gold Miners ETF (NYSE: GDXJ). It’s a basket of the best mid- and smaller-tier miners. These miners will probably outperform on the next leg higher.

I talk about this fund all the time. If you bought it when I mentioned it in, say, June, you’d be up about 22% right now. That easily outpaces the 13.5% gain in gold itself … or the 10% gain in the S&P 500 over the same time frame.

Take a look at a performance chart of all three …

You can see that the GDXJ is outperforming. You can also see that it’s a bumpy ride. Individual stocks have outperformed even more … but their rides have been even more of a rollercoaster.

As long as you keep your eyes on the big trend and have some steel in your spine, you’ll do fine.

But NOW is the time to invest in gold. Seize the moment. Go for the gold!

All the best,

Sean