Copper Hit a 10-Year High — Is It Too Late for You To Buy?

Man, I told you this would happen. In my Feb. 17 Wealth Wave, I gave you “3 Reasons Why You Should Buy Copper Miners Right Now”. And just this week, copper soared to a 10-year high.

Did you listen? Or did you wait? Here’s the good news: Even if you held off buying copper miners — which are leveraged to the metal — you can still make a fortune!

Copper hit $10,000 per metric ton on the London Metals Exchange this week. This was the initial target for prominent Wall Street analysts. Only they expected copper to hit that price level maybe by the end of the year. And it’s only May!

Now, those same analysts — most notably from Bank of America Corp. (NYSE: BAC) and The Goldman Sachs Group (NYSE: GS) — are ratcheting up their price targets again … as high as $13,000 a ton.

My strong belief is their price targets may be too LOW.

Supply Crunch Is Getting Worse

Wall Street was already expecting a deficit in copper demand this year. That’s due to a one-two combo.

The first part is surging demand as the global economy comes out of the pandemic, igniting all sorts of industrial demand. The second is a supply squeeze. There were several mine closures during the pandemic. But that was just the copper-plated cherry on top of a long-term supply problem, as old copper mines run out of ore. And for a long time, prices were too low to spark new exploration.

Sure, we have higher prices now. But it takes many years to bring a deposit from an interesting patch of dirt to a producing mine.

Next Year Will Be Even Tighter

And that brings us to the next price-squeezer — the supply crunch is projected to be even worse next year. A supply/demand deficit projected at 185 metric tons this year should double to 369 tons next year.

We may see some relief in supply by 2023. That’s not from new mines — as I said, those take years to start up. But as prices go higher, we’ll probably see a lot more recycling of scrap copper.

The EV Wild Card

Then there’s the electric-vehicle market. It’s ramping up fast, and no matter how high analysts raise their EV sales estimates, they never seem to raise them high enough.

If you weren’t already aware, EVs use a lot of copper. A conventional car uses 18-49 pounds of copper. A plug-in hybrid electric vehicle (PHEV) uses about 132 pounds of the metal, and a battery-powered electric vehicle (BEVs) contains roughly 183 pounds. Electric buses and trucks contain a lot more. Sure, that varies from vehicle to vehicle. And as time goes on, systems will become more efficient (and use less copper, hopefully).

So that’s why it’s a wild card. We simply don’t know how much copper the global EV market will demand.

Still Way Early in the Commodity Supercycle

I’ve pounded the table about the fact that the world is entering a commodity supercycle. You see it not only in the rising price of copper, but also soaring lumber … steel … aluminum … palladium. Heck, even the soft commodities like corn and wheat are blasting off.

But this blast off is just the beginning. The commodity supercycle has a long way to go. We know this because …

A. Supercycles last for years, and …

B. Commodities must rise much, much higher just to get back to a normal relationship with the stock market.

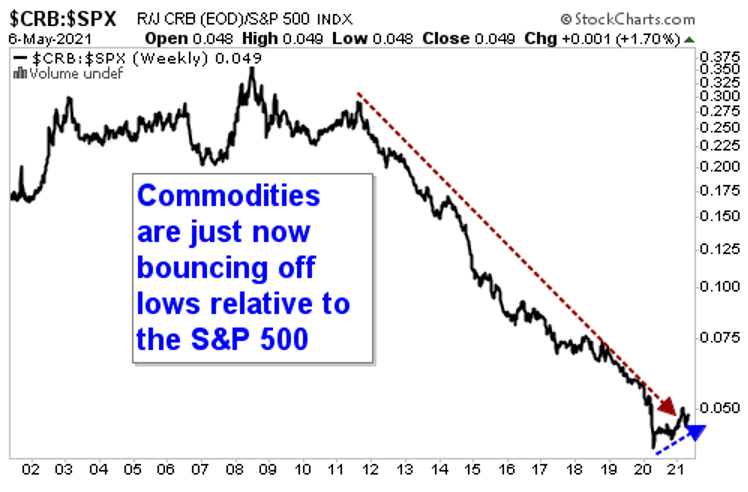

To see what I mean, look at this 20-year chart of the CRB Index — a basket of leading commodities — divided by the S&P 500.

You can see the bottoming process has only begun. There’s a LONG way to go. And it’s likely — for all the reasons I just told you — that copper will be one of the commodities that leads the way.

How YOU Can Profit

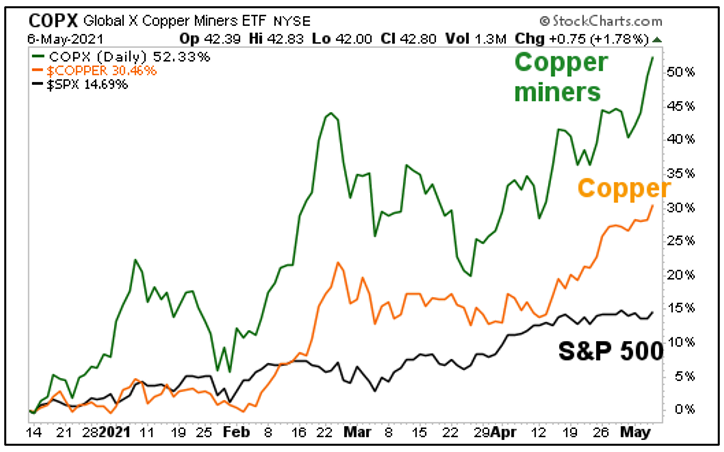

The Global X Copper Miners ETF (NYSE: COPX) is an excellent way to play this move.

You can see that so far this year, the S&P 500 is up 14.69%. Not bad. Copper is up 30.46%, DOUBLE the move in the stock market. Nice! But copper miners, as tracked by COPX, are up a whopping 52.33%. Their leverage to the underlying metal acts like a stock-market supercharger!

Again, this is STILL early days. We’re in a supercycle. There’s a LOT more to come.

One thing’s for sure … you don’t want to miss this move. As always, continue to do your own due diligence before buying anything.

All the best,

Sean