As I walked my faithful dog this morning, I came across a goose sitting atop a neighbor’s roof. You couldn’t miss this goose. It was squawking like a Fiat being run over by a Mack truck.

A friend of mine who is a birder tells me it’s an invasive species called an Egyptian goose.

Now, you know I’m a fan of history, so here’s a little fun fact: Romans used geese as watch birds. That’s because, back in the day, an army of barbarians mounted a sneak attack on Rome. The guards were asleep. But watchful geese raised the alarm and saved the city.

Now, obviously I don’t think this goose was warning me of anything serious. But I do think there’s a lot of economic squawking that the federal government and Wall Street are ignoring.

I’m talking about the COVID-19 outbreak. Wall Street is acting like the virus will be over and done with in the third quarter. And based on President Trump’s words and actions, it’s obvious he wants to put this nightmare in America’s rear-view mirror, too. Well, who doesn’t?! But here’s my view: We are in for a long, hard slog. I expect it to last AT LEAST through mid-2021. And that’s not being priced in by Wall Street.

And you know what? I’m not even the real pessimist here. Pulitzer-prize winning Laurie Garrett is author of “The Coming Plague,” and has a reputation as one of America’s “Coronavirus Cassandras.”

And if you’re rusty on your Bullfinch’s mythology, Cassandra delivered bad news that no one wanted to hear.

The Coming Plague

Garrett recently told the New York Times that “I’ve been telling everybody that my event horizon is about 36 months, and that’s my best-case scenario.”

Three years is a LOT longer than any forecast the White House or Wall Street is working with.

Garrett expects the pandemic to keep reoccurring in localized waves. “It won’t be a tsunami that comes across America all at once and then retreats all at once.” She expects outbreaks “that shoot up in Des Moines and then in New Orleans … and so on, and it’s going to affect how people think about all kinds of things.”

What kind of things? My own list includes travel, especially business travel. People in the business community are finding they can accomplish a heck of a lot on Zoom Video Communications (ZM). You know who will suffer from that change? Airlines, sure. But also hotels. And those industries are just the tip of the iceberg.

The Old Normal is Gone

Stop waiting for things to go back to “normal.” The old normal is gone.

“This is history right in front of us,” Garrett told the Times. “Did we go ‘back to normal’ after 9/11? No. We created a whole new normal. We securitized the United States. We turned into an antiterror state. And it affected everything.”

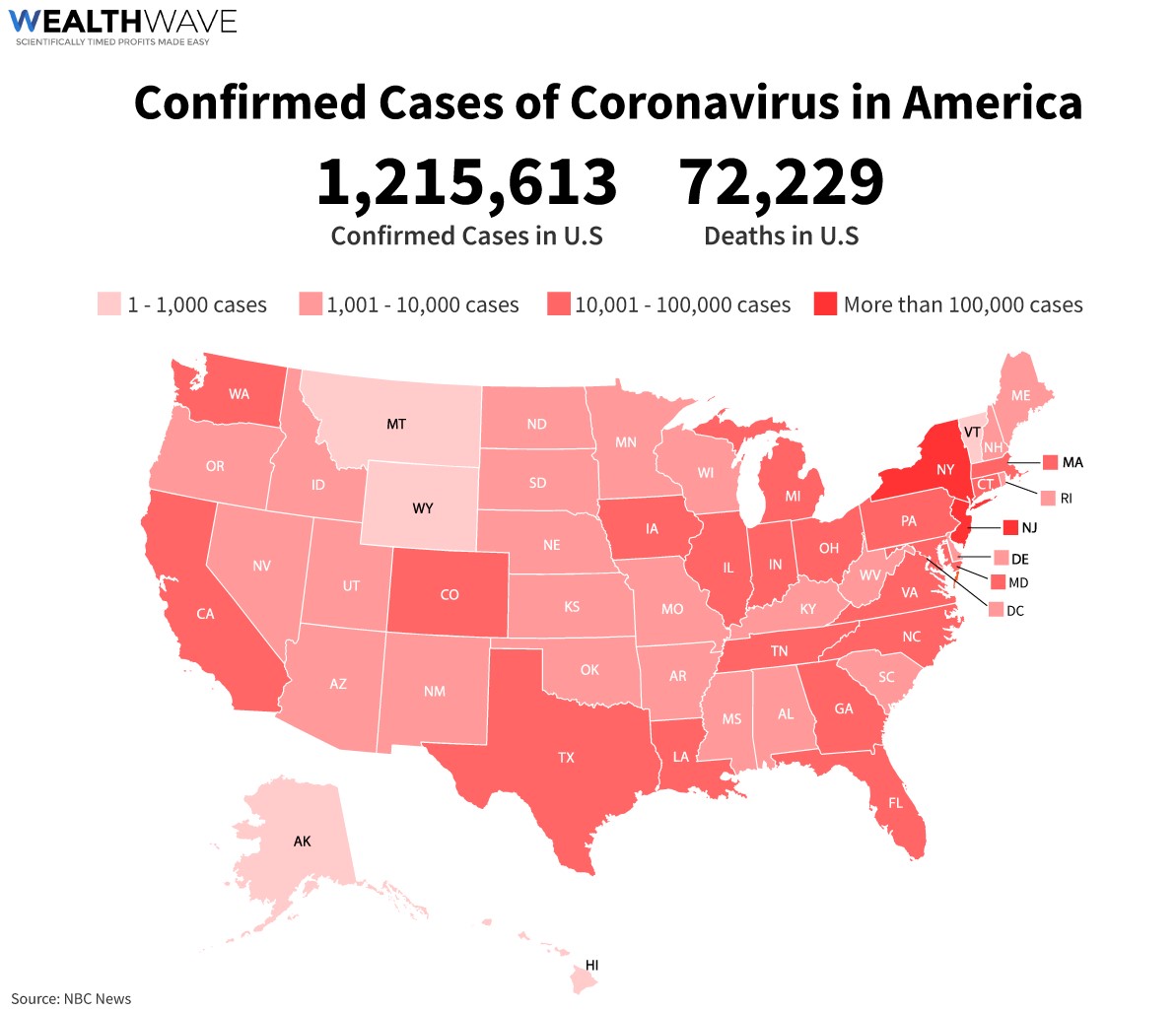

So that brings me to my next point. You may have heard that the Trump administration is privately projecting deaths from COVID-19 to reach 3,000 per day by early June. So far, the U.S. has suffered more than 72,000 deaths through Wednesday morning.

And 3,000 a day is more Americans than we lost on 9/11 (2,977).

So yeah, the pandemic is going to change American life — the way we work, socialize and more — permanently.

Infections Are Rising

You may have heard the White House told states they could reopen as long as their number of new cases trended downward for 14 days. However, states don’t seem to be listening.

Outside of New York, cases are still trending higher. Here’s a chart showing the number of new cases in the New York metro area and in the rest of the U.S. …

Perhaps unquestionably, reopening states will trigger new infections. On CNBC, Dr. Scott Gottleib said, “The reality is we can predict cases are going to go up over the course of May. As we start to reopen the economy, restart activity … you’ve got to expect cases are going to go up.”

Lessons from Success Stories

Now, let’s talk about the lockdown. Hindsight is 20/20, but I think it was done incorrectly. We concentrated on the wrong things. How can I tell? Just look at what other countries, ones that are now sharing their success stories, did.

South Korea went from the largest COVID-19 outbreak in the world to zero domestic cases in 60 days. Seven weeks ago, South Korea and the U.S. had the same number of COVID-19 deaths. Today, South Korea has less than 300 and the U.S. has more than 70,000. In fact, South Korea NEVER had to shut down its economy at all!

What did South Korea do right? Well, it’s COVID-19 response strategy sits atop three pillars:

- Fast and free testing

- Expansive tracing technology

- Mandatory isolation of the most severe cases

All good ideas. None are being pushed by the U.S. Federal government.

Taiwan has also been very successful against the virus. Its economy is open, too. They credit the same three reasons above AND cheap medical care for their success.

Unfortunately, there’s not a snowball’s chance in hell of that happening in the U.S. anytime soon.

Ideas for Investors

There’s more bad news: In a model cited repeatedly by the White House, the University of Washington’s Institute for Health Metrics and Evaluation almost doubled its predicted U.S. deaths to 134,000 by mid-August. The reason: “premature relaxation of social distancing”.

So, what should you do as an investor? I have a couple ideas.

My subscribers are doing very well with COVID-19 picks. I talked about many of them in my recent Coronavirus Financial Survival Guide.

Two examples from that report:

Abbott Laboratories (NYSE: ABT) makes tests, including COVID-19 tests. It’s going full blast right now and doing well for my Supercycle Investor subscribers.

Gilead Sciences (Nasdaq: GILD) created the first effective COVID-19 treatment, Remdesivir. And that’s just one of the treatments its’ working on. It’s doing well for my Wealth Megatrends subscribers.

There’s more where that came from. We’re in for the long haul in our battle against COVID-19. The metaphorical geese are squawking loudly. Investors would be wise to listen.

All the best,

Sean