Oh, man, I’m excited. There was some news out this weekend that shows a clear path for gold higher. Sure, it won’t be a straight line. Gold always zigs and zags.

But it’s like a tidal wave, triggered out in the ocean by an earthquake. A ship sailing far out to sea might experience the tidal wave as a wave that’s just a little bigger than usual. It’s only when the tidal wave closes into the shallows near the shore that it finally starts to rear up … and up … and up.

I’ll explain a lot more when I speak at the New Orleans Investment Conference. It’s a virtual conference this year, so you can attend remotely, but you MUST sign up ahead of time. The NOIC starts tomorrow morning and I speak on Thursday morning. I also have a virtual workshop, in which I name plenty of up-and-coming gold and silver miners, developers and explorers. To attend without leaving the comfort of your home, go here now.

Even before the conference, let me share a few charts I think you’ll find illuminating on what’s happening with gold.

First, you know that Washington is working on a new $1.8 trillion stimulus package. While details are sketchy at this time, this is an election year, so you know some kind of stimulus will pass. Here’s the thing: The U.S. has already thrown $6 TRILLION at the coronavirus. A lot of it was siphoned off to pad the pockets of billionaire fat cats, but that’s how Washington works.

My point is, we are spending money so fast that the electronic printing presses might be about to make the jump to light speed. And every dollar created and thrown into Washington’s deficit black hole dilutes the value of every other dollar. That’s why the U.S. dollar is in a downtrend, and gold is rising. Let me show you a chart …

Since its peak in March, the dollar is down 10.5%. That’s a HUGE move in a currency. Gold has risen at the same time. This is no coincidence. Since gold is priced in dollars, the metal and the dollar often move in opposite directions.

Things always zig-zag, so the U.S. dollar has tried to bounce from a low it hit Sept. 1. But that effort seems to be running out of gas. Meanwhile, gold peaked in August and is coiling up for its next move. My bet is gold moves higher, breaks out, and goes into rampage mode.

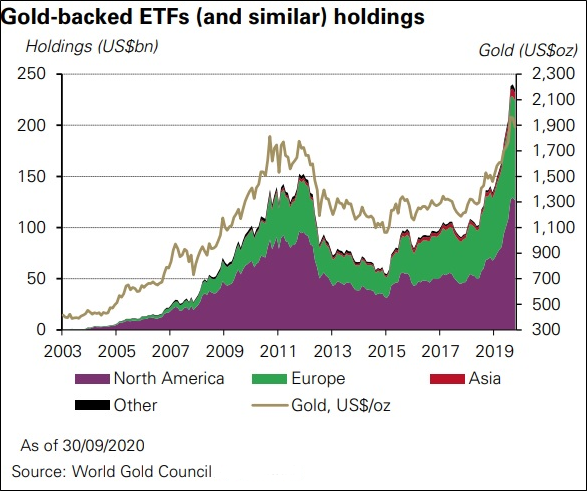

You know who else thinks that way? The investors and institutions that use gold exchange-traded funds (ETFs) around the world. Holdings in those physical gold ETFs just soared to a new all-time high.

According to data from the World Gold Council, gold ETFs have added stacked up more than 1,000 metric tons for the first time ever. This beats the 2009 record of 646 tons, set during the last financial crisis.

Here in the U.S., the SPDR Gold Shares (NYSE: GLD) and iShares Gold Trust (NYSE: IAU) collectively added over $2 billion worth of gold in September. Holy smokes!

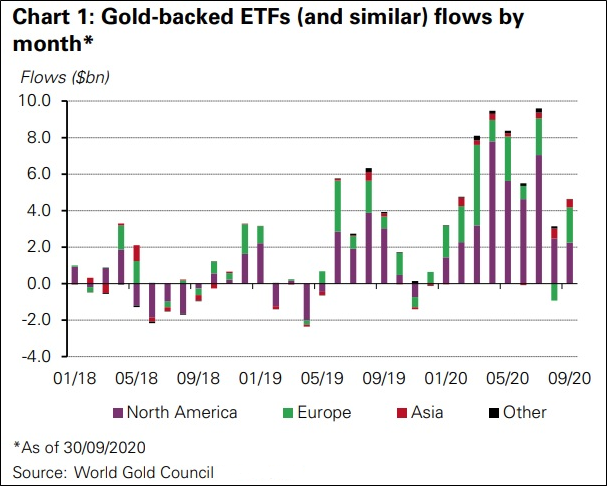

I have some charts on the ETF action from the World Gold Council. Let’s take a look …

The above chart shows how much ETFs are adding month to month. It compares what happened in the first nine months of this year to last year. You can see that this year stacking by gold ETFs suddenly kicked into overdrive.

Next, let’s look at total gold holdings in the world’s ETFs …

I encourage you to read the entire World Gold Council report. When you do, you’ll probably come away just as bullish as I did.

Oftentimes, when we talk about the gold market, we talk about supply. There hasn’t been a new major gold discovery in years. Exploration spending has gone way down, which probably means even fewer discoveries. Grades are going down, which means miners have to dig up more and more ore to get the same amount of gold. And so on.

But now — NOW — we can clearly see the demand side of the equation. It is big. It is getting bigger. And like a tidal wave roaring in from deep waters, it is very close to crashing on our shores.

I’ll have more to say at the New Orleans Investment Conference. I hope you attend. It’s going to be great!

All the best,

Sean