One Possible Way Biden’s Infrastructure Plan Can Make You Rich

Yesterday, President Joe Biden unveiled a $2.25-trillion U.S. infrastructure plan in Pittsburgh. It’s the most sweeping government investment since the 1960s space program.

Some of the details of the four-part, eight-year plan include:

• $621 billion for transportation. This includes a doubling in federal funding for public transit, as well as money for roads, bridges and electric vehicles (EVs). $1.4 billion of that is earmarked for alternative-fuel charging infrastructure, like EV charging stations.

• $650 billion for initiatives tied to clean water, high-speed broadband and upgraded electrical grids. $40 billion of that money is for new wastewater infrastructure, and $25 billion is for drinking water infrastructure.

• $580 billion for strengthening American manufacturing. $180 billion of the manufacturing money is earmarked for the biggest nondefense research and development program on record. This includes research in electric vehicle technology, lightweight materials, 5G and even artificial intelligence.

If you’re wondering, the plan will be paid for by increasing the corporate income tax to 28% from 21% and by setting a minimum tax on corporate earnings overseas.

The plan still has to make it through Congress. House Speaker Nancy Pelosi aims to move the infrastructure bill through the House of Representatives by July 4. Republicans already hate it, and maybe it will stall. But Wall Street is betting the infrastructure plan gets passed, even if it changes in the process.

A lot of media pundits are mystified that stocks aren’t selling off on the news of higher corporate taxes. I’m not. There’s a grapevine from Capitol Hill to Wall Street, and you can bet legislators broke the news to their corporate patrons far in advance. So, that news is priced in.

For regular investors, there are many opportunities. I’m already giving some of the best opportunities to my premium service subscribers. But let’s talk about one opportunity that’s available to YOU today.

The Global X U.S. Infrastructure Development ETF (BATS: PAVE) is dedicated to U.S. domestic infrastructure stocks. By that, I mean it holds a basket of companies that will benefit from rising infrastructure spending in the United States.

Its holdings include Deere & Co. (NYSE: DE), Parker-Hannifin Corp. (NYSE: PH), Eaton Corp. Plc (NYSE: ETN), Norfolk Southern Corp. (NYSE: NSC) and Emerson Electric Co. (NYSE: EMR). Many of its holdings are high-priced stocks, trading for hundreds of dollars a share, which may be too expensive for you. But the ETF itself is affordably priced, recently trading around $25 a share.

The fund has $2.26 billion in assets under management and a total expense ratio of 0.47%. Recently, volume has soared. Gee, I wonder why?

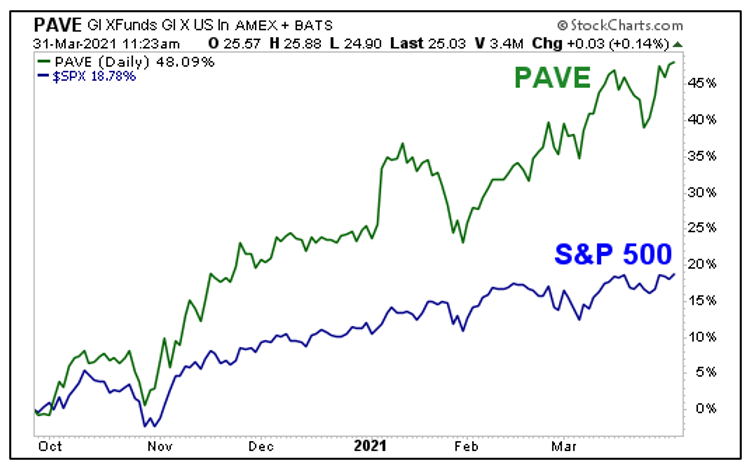

Let’s take a look at a performance chart comparing PAVE to the S&P 500:

Over the past six months, the S&P 500 is up a respectable 18.8%. PAVE, meanwhile, is up 48.09% — two-and-a-half times the performance of the S&P.

As the great Yogi Berra once said, “it’s hard to make predictions, especially about the future.” But in a time when the government is literally throwing TRILLIONS of dollars at infrastructure, it’s likely that PAVE’s outperformance will continue.

And that’s the kind of move that could possibly make you rich.

All the best,

Sean