As I’m writing this, I’m looking at the most recent pick I gave my Marijuana Millionaire Portfolio subscribers on Friday. KushCo Holdings, Inc. (OTCQX: KSHB) is up 30% in just three trading days. That compares to 2% for the S&P 500!

Sweet! But I think there’s a lot more where that came from.

It doesn’t hurt that KushCo is the packaging supplier for much of the legal marijuana industry, and it has distribution centers across the country. That makes it one of the biggest “picks and shovels” plays in the cannabis industry.

About 60% of KushCo’s revenue comes from its vaporizer hardware and technology segment. 30% comes from packaging and other supplies. And 10% comes from its segment that sells ultra-pure hydrocarbon gases and solvents to the cannabis and CBD sector.

All this is nice. But KushCo’s business fundamentals aren’t the main reason I picked it.

So … how did we pick KushCo, one of the two picks I gave Marijuana Millionaire Portfolio subscribers last week?

The same way we do it every week — using the Weiss Cannabis Stock Rankings. That’s our proprietary black-box system for picking cannabis stocks, and it is proving nigh-unbeatable in this market.

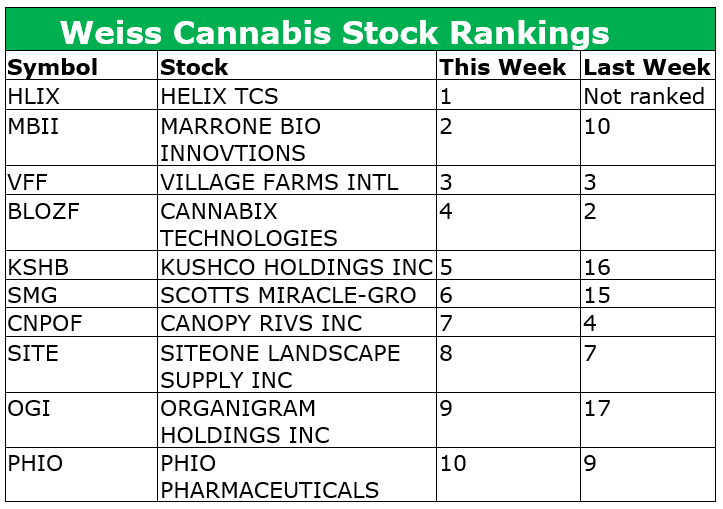

Here’s the top 10 Weiss Cannabis Stock Rankings from Friday …

You’ll note that KushCo is No. five on this list. Village Farms International, Inc. (Nasdaq: VFF) is already in the portfolio and doing well. I did pick one other stock from the top five, and it’s rallying too, though it’s not as red-hot as KushCo.

Once I get the Weiss Cannabis Stock Rankings, I do fundamental analysis of each stock. That’s where I got the latest updates on KushCo, a company I’ve been following for some time. And that’s when I make my final pick(s).

That’s what I do every week. And sure enough, as of writing, ALL the recommended positions in Marijuana Millionaire Portfolio are in positive territory. I’m talking open gains of 103%, 185%, 192%, 196% and more.

We also take gains in Marijuana Millionaire Portfolio, too. Again, the Weiss Cannabis Stock Rankings play a part, because when picks start to sink fast, that’s a signal it’s time to consider getting out.

In just the past two months, we’ve banked gains of 28.7%, 100.7%, 137.9%, 62.2%, 107.9%, 108.5%, 1008.8% and 71.7%!

Sure, not every trade is a winner. But we aim to keep our losses small, and let our winners run. And the Weiss Cannabis Stock Rankings help — a LOT!

To be sure, it’s easy to be a genius in a bull market. And cannabis is enjoying one of the most rip-snorting bull markets we’ve seen in in years!

Here are three things you should keep in mind when considering: “Should I invest in cannabis stocks now?”

1. The New Administration Is Canna-biz Friendly

President Trump left the fate of marijuana’s gray legal status to a series of attorneys general who hated cannabis. Yeah, I’m talking about you Jeff Sessions and Bill Barr.

These jokers made life difficult for the small businessmen (and women) in the cannabis industry. But the worst was then Senate Majority Leader Mitch McConnell. He flatly refused to allow any pro-marijuana business bill to reach the floor of the Senate.

Now, McConnell is out, and Sen. Chuck Schumer is in as the new majority leader. Schumer says marijuana legalization will be “a priority”.

And even if Schumer can’t legalize it — and there are plenty of anti-cannabis legislators on both sides of the aisle — there’s still good news. President Biden is appointing pro-marijuana legislators to key posts.

The latest is former South Carolina Democratic Party Chair Jaime Harrison, who is Biden’s pick to lead the Democratic National Committee. A push from the DNC to emphasize marijuana reform could be very influential.

2. America Is Ready for Legal Cannabis

A whopping 91% of Americans are in favor of legalizing cannabis for either medical or recreational use.

To be sure, that doesn’t matter a tinker’s cuss unless state governments go along, and they are notorious foot-draggers. But so far, 34 U.S. states have legalized recreational and/or medical marijuana.

And the legalization parade marches on. New York, the big enchilada of the mid-Atlantic, could be next. Gov. Andrew Cuomo says he wants to legalize as early as April. He says that legalization could bring New York $300 million in desperately needed tax revenue, as well as 60,000 jobs and $3.5 billion in economic activity.

Which brings me to my next point …

3. Booming Cananbiz Revenue Means More Tax Revenue

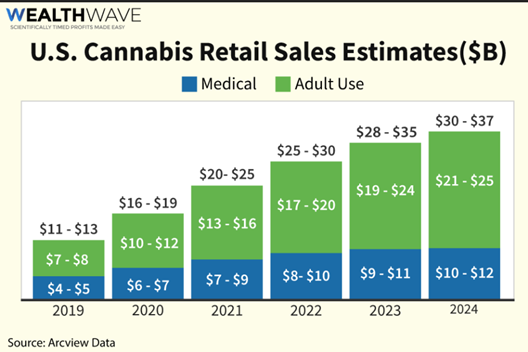

The charts on projected growth of marijuana revenue are just stunning. Here’s another one, made with data from Arcview Research …

That’s a projected compound annual growth rate of 23.27%. Just astounding. And it’s catching the eyes of states which are strapped for cash due to pandemic-triggered economic hardship.

Heck, some states are already seeing tax revenues roll in. Colorado has collected nearly $1.6 billion in tax revenue from cannabis over the past six years. Massachusetts, which just legalized two years ago, has collected $200 million in tax revenue.

In Chicago, Mayor Lori Lightfoot was recently able to cancel plans to lay off 350 city employees. And the reason she gave was higher-than-expected marijuana tax revenues.

Bottom line: There are MANY forces lining up to legalize cannabis. So, it’s no surprise that many marijuana stocks are going higher.

But here’s a dirty little secret: Not all cannabis stocks go higher. Some go down. Some implode. Some seem to have all the right ingredients, and they still turn out to be a steaming bowl of nothing!

So how can you find the good buds among the weeds? Well, you can do as I’ve recommended previously and just buy a marijuana fund like the AdvisorShares Pure Cannabis ETF (NYSE: YOLO). It’s up 54% in the past two months alone.

Or, if you want to aim for BIGGER returns, you can find an edge. A secret weapon.

My secret weapon is the Weiss Cannabis Stock Rankings. And I’ll be sending a new list of those rankings to subscribers TOMORROW! If you want to join us, I suggest clicking here.

Stay tuned. We’re still in the early days in this cannabis bull market. The next leg of gains could be extraordinary.

All the best,

Sean