The Only Thing the Oil Market Has to Fear is Fear Itself

Have you seen the energy markets recently? Crude oil got hammered. And leading oil stocks fell through the floor! What the heck is going on?!

Today, I’ll give you the scoop and tell you about a couple of opportunities.

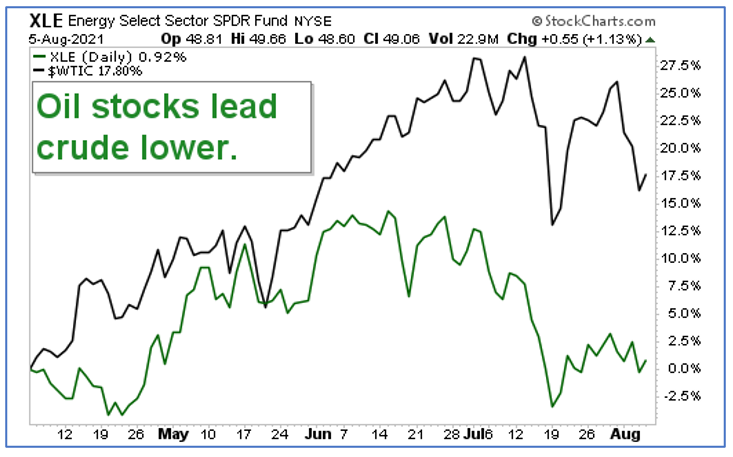

Let’s start by looking at a performance chart of Energy Select Sector SPDR Fund (NYSE: XLE) (the green line) against West Texas Intermediate, the U.S. crude oil benchmark (the black line).

You can see that they zigzagged higher together. Then, in June, oil stocks (as tracked by the XLE, plateaued, then started to slip, even as oil continued higher.

In July, oil stocks AND oil hit the skids. Crude oil tried to bounce, but the lack of a rally in the stocks told you what was going to happen: Oil keeled over again!

So, what you’re seeing here is oil stocks LEADING crude oil — ANTICIPATING what will happen next as the next phase of COVID-19 plays out.

I believe what happens next is more short-term pains leading to long-term gains.

Why Is the Oil Market Getting Hammered?

Basically, it’s the pandemic. Not only here in the U.S., but around the world, and especially in China.

China is seeing an outbreak of new cases. As a result, the country just announced it was testing all 12 million people in the city of Wuhan again. It’s also restricting travel, which is already having an effect. Traffic congestion in Beijing has declined by 30% over the past week and is also falling in other parts of the country.

In the U.S. and Europe, hospitals are once again flooded with COVID-19 patients. And this is whipping the oil market into a fear-fueled frenzy as traders worry that we’ll see lockdowns like last year when oil demand fell off a cliff.

So, short-term pain. But in the longer term, to paraphrase FDR, the only thing the market has to fear is fear itself. I’ll give you three reasons why.

1. The U.S. Won’t See Widespread Lockdowns

For one thing, lockdowns hurt businesses more than they helped slow the spread of the virus. Numerous governors across America are already saying they won’t be locking their states down. The COVID-19 resurgence is predominantly being driven by the unvaccinated, so there’s a large segment of the population that, while not risk-free, is at a much reduced risk of getting seriously ill.

2. Oil Supply Remains Tight

The alliance of OPEC nations and oil-rich riffraff led by Russia is being careful about how much production is brought back online, ensuring the market isn’t flooded. That’s supportive of prices.

Moreover, a lot of U.S. shale oil got shut in permanently when oil prices cratered last year. According to the country’s biggest shale producer, EOG Resources, Inc. (NYSE: EOG), U.S. oil output will only have “small growth” at most next year. EOG cites two reasons: low spending on fresh production and well efficiency improvements for the industry topping out.

Shale oil made the U.S. the global swing producer for years. That’s unlikely to happen again for a long time. Less supply means higher prices. Meanwhile …

3. Global Oil Demand Continues to Ramp Up

Even amid the pandemic, consumers around the world are going out and spending, and the world’s factories are shifting into higher gear. According to the International Energy Agency, following a record decline of 8.6 million barrels per day (bpd in 2020, global oil demand should rebound by 5.4 million bpd in 2021 and a further 3.1 m bpd by 2022 to average 99.5 mb/d).

And by the end of 2022, global oil demand should surpass pre-COVID-19 levels.

So, while the market works through its fear, oil prices will go lower. Once the market realizes this year isn’t as bad as last, we’ll see prices head higher again.

This brings up a couple opportunities.

First Opportunity: Refiners

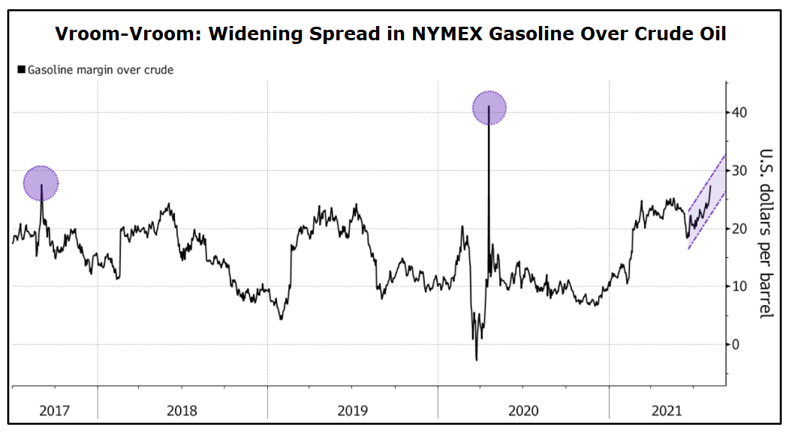

Have you noticed gasoline prices are going down a lot slower than the price of oil? Funny how that happens, right? But the fact is, gasoline demand is still going higher. So this means the “crack spread” — the refining margin difference between the cost of oil inputs and the price of refined products — is getting wider and wider.

The margin on a barrel of motor fuel over a barrel of West Texas Intermediate reached more than $27 Thursday in New York Mercantile Exchange trading. Except for that one day in April of last year when oil markets panicked and the price of crude briefly went negative, this is the best margin for gasoline over crude in four years.

The big winners are refiners. You can buy individual stocks, or you can just buy the VanEck Vectors Oil Refiners ETF (NYSE: CRAK), which is a basket of the best refiners.

Second Opportunity: Buy the Next Bottom in Oil

As I mentioned, the market’s still in panic mode and could go lower. It’s hard to project panic, but XLE could fall to $39 a share, about 20% lower from recent prices. If panic really grips the oil market, my target for West Texas Intermediate is $57 a barrel, about 17% lower.

But those are just targets — they can move around.

What if we don’t get to $39 on XLE and $57 on oil? I’ll know the bottom — and you will too — when oil stocks start to lead oil prices higher again. That’s a great time to buy. It would also be a good time to sell those refiners you bought, if you were only in them for the short term.

Again, Wall Street is giving in to its fears, pricing oil for the worst. That’s painful in the short term, but it leads to massive longer-term opportunities.

I’ll be ready. Will you?

All the best,

Sean