Spanish conquistadors saw platinum (aka “white gold”) as an impurity.

They threw it away!

… despite the fact that it’s 30 TIMES RARER that the shiny yellow stuff they were after.

3,332 tons of gold were mined globally in 2018, mostly in China, Australia and Russia. That same year, only about 190 tons of platinum were mined, mostly in South Africa and Russia.

That’s mainly because platinum is far more difficult to produce, as it’s buried deeper in the earth. And it requires a more difficult purification process.

Also, unlike gold (for the most part), it’s a useful metal … being vital to things like catalytic converters, aircraft engines and medical devices like pacemakers.

But, like gold, it’s a precious metal highly sought after in jewelry.

Because of all this, you’d think platinum would be a lot more costly than gold.

YOU’D THINK.

The truth of the matter is … we’re in the midst of an historical anomaly:

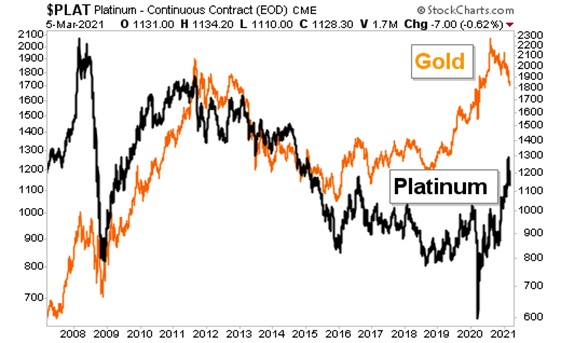

Before 2008, platinum generally traded at a higher price than gold. Now, it’s just over $1,100 an ounce, compared to gold’s $1,700.

I’d say that platinum could be grossly undervalued. And that’s why it makes sense to pay attention to this rare commodity as a potential investment.

In fact, the world’s top platinum miner — South Africa’s Sibanye Stillwater Ltd. (NYSE: SBSW) — said the price of the metal could climb more than 80% over the next four to five years … as the world economy recovers and supply dwindles.

Already, platinum has almost doubled from its 18-year low last March, amid supply disruptions and a revival in China’s auto industry, which uses the metal in catalytic converters.

Until recently, platinum has dominated in diesel exhaust systems. But its cheaper price — relative to the palladium used in most standard vehicles — is causing many manufacturers to switch back to platinum.

This could boost platinum demand by at least 300,000 ounces a year according to Trevor Raymond, director of research at the World Platinum Investment Council.

Platinum will also be supported by rising use in hydrogen fuel cells. As Raymond says, “What has happened during COVID is that the world has become more aware that the hydrogen economy is probably a certainty.”

“Platinum has only just started to re-rate and it will continue,” Sibanye Stillwater’s CEO Neal Froneman said in an interview from his farm in South Africa’s Limpopo province. “There is no reason why platinum will not eventually trade at $2,000 an ounce and probably even higher.”

The metal is benefiting from shifting supply and demand, as concerns grew that South Africa, the top producer of the precious metal, could see more supply disruptions as the nation deals with vaccine issues.

According to an analyst at Société Générale S.A., a supply-crunch threat in platinum is creating strong bullish sentiment not seen in years, with speculative long positions reaching multi-year highs.

Analysts at ABN AMRO said they see platinum outperforming other assets. Strong jewelry demand out of China, renewed industrial demand and an improving automotive sector are all factors that will buoy platinum prices through 2021, says Georgette Boele, senior precious metals strategist for the Dutch bank. “Slowly but surely the stars are aligning for this precious metal.”

Boele sees platinum prices pushing above $1,300 an ounce by the fourth quarter.

Platinum soared 22% from the start of 2021 through mid-February, making fresh six-year highs.

Is it too late to get onboard this train?

Nope!

The good news is that the price of platinum has pulled back to the 50-day moving average, giving you a golden (or platinum) opportunity to buy the dip! You can see that pullback in the shares of the Aberdeen Physical Platinum Shares ETF (NYSE: PPLT). This ETF holds physical platinum and tracks the metal closely.

The last time the PPLT bounced from the 50-day moving average, it rallied 43%! That might not happen this time. But while history doesn’t repeat, it often rhymes.

Also, like gold and silver, platinum bullion is available from online dealers like Kitco or Apmex (although the availability of certain coins is tight).

And like gold and silver, you can buy “allocated” coins or bars with your name attached. The advantage is that there are no shipping costs, and you don’t have to worry about finding somewhere to safely store your precious metals. And you can ask for your metals to be shipped to you at any time.

Hard Asset Alliance is one option (although I don’t personally stand to benefit from any dealer recommendations). You buy your precious metals through them and then choose where you want them to be stored … in New York, Salt Lake City, London, Zurich, Singapore or Melbourne.

All the best,

Sean